Economy and business

China leaves rates unchanged first, but there is room for future declines

After China’s 5-year LPR (interest rate quoted in the loan market) was significantly reduced by 25 basis points last month, in March it remained “on hold.” There is no change by now, but there is space for future cuts.

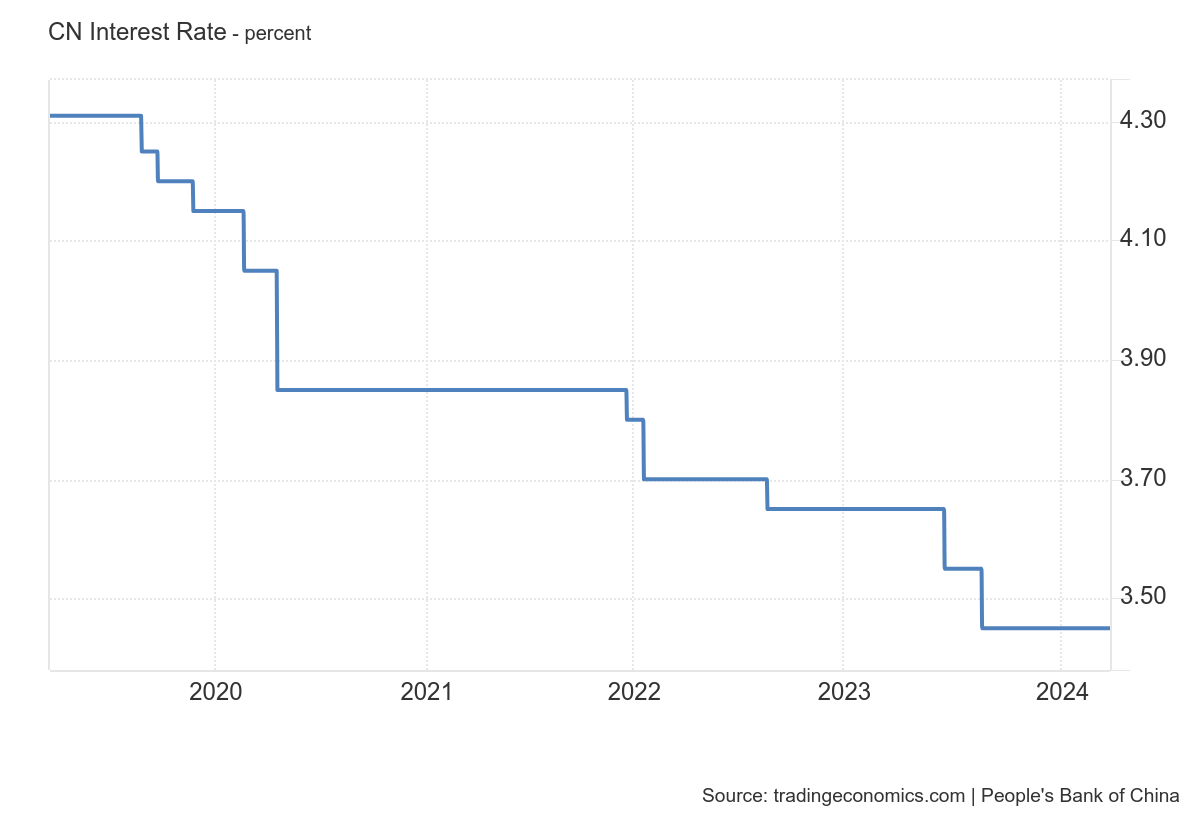

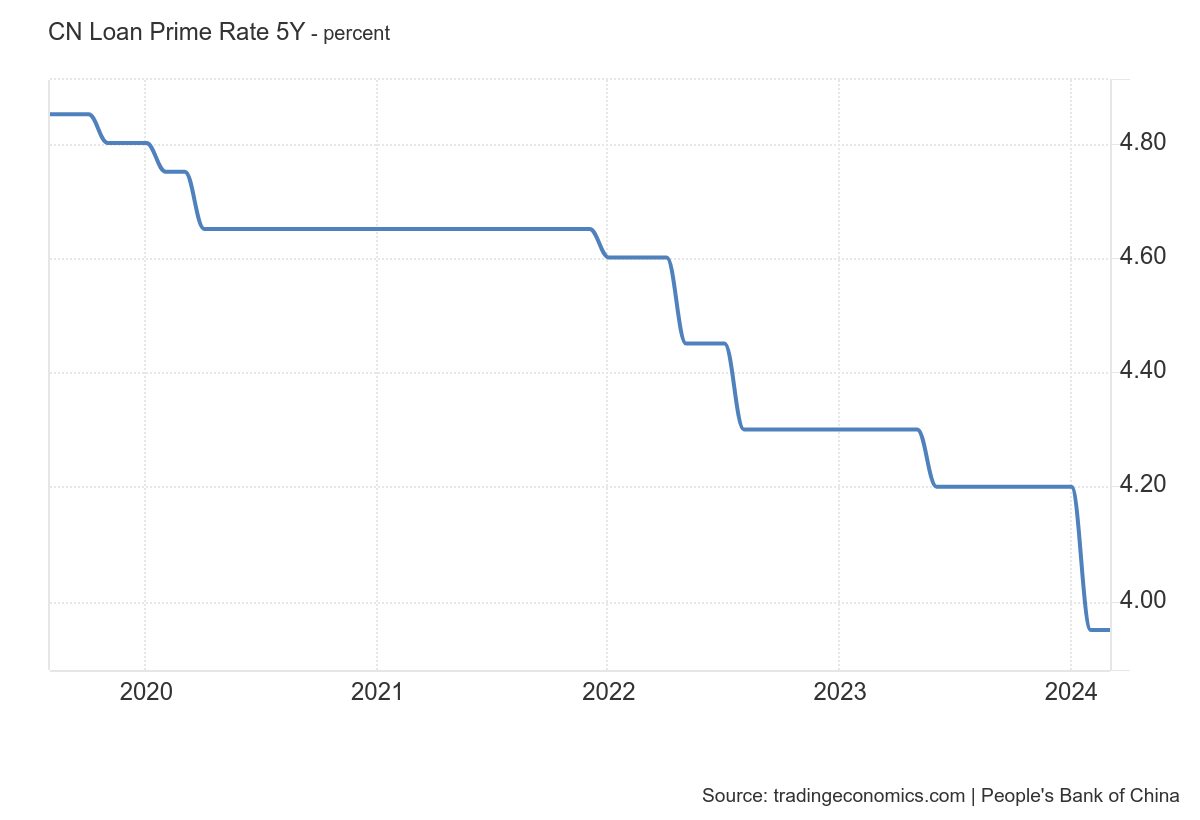

On the 20th, the People’s Bank of China authorized the National Interbank Financing Center to announce the latest LPR: 1-year LPR was at 3.45 percent, and 5-year and above LPR was at 3.95 percent, both unchanged from last month. Here is the interest rate at 1 year

As you can see from the charts, there are no changes

And here, at 5 years

Zhou Maohua, a macro researcher at the Financial Markets Department of China Everbright Bank, analyzed that the LPR was “hovering” in March, in line with market expectations.

Three things impacted this holding decision the most:

- First, the financial data from January and February were ideal; commercial financing grew steadily, and domestic demand was steadily recovering.

- Second, the net interest margin of some banks was under severe pressure.

- Third, the MLF (medium-low interest rate) term loans, which had a direct impact on LPR that month, remain stable, and the resistance of commercial banks to adjust short-term LPR is great.

LPR remains stable, but it does not prevent finance from further benefiting the real economy. According to Zhou Maohua, it is anticipated that the central bank will keep using structural tools to take advantage of the potential of interest rate market reform. Also, the PBOC will advise financial institutions on how to optimize their asset and liability structures, increase the area in which financial institutions can contribute to the real economy, and successfully cut financing costs in emerging markets and weak points in the real economy.

Zhou Maohua also believes that there is room for a lowering of LPR, especially since the beginning of the year, when the interest rate on government bonds has fallen further and is lower than the level of the interest rate on deposits in the same period, creating conditions for a reduction in the interest rate on bank deposits. At the same time, the domestic economy is steadily recovering, prices are at a low level, and there is sufficient room for monetary policy.

However, experts also said that with the steady economic recovery, market supply and demand will also change, and the space for subsequent LPR interest rate cuts will narrow. (Above)