Economy and business

European Tax paradises drains Italian Corporate Tax Income

Italy is bleeding. Every year, a river of money equal to 18% of its corporate tax revenue vanishes, swallowed up by tax havens. The merciless data reveal a reality in which multinationals, exploiting the wide loopholes of a permissive European system, divert their profits to countries with more accommodating tax regimes, leaving Italy high and dry. These datas are from the research Missing Profits. data refers to 2019.

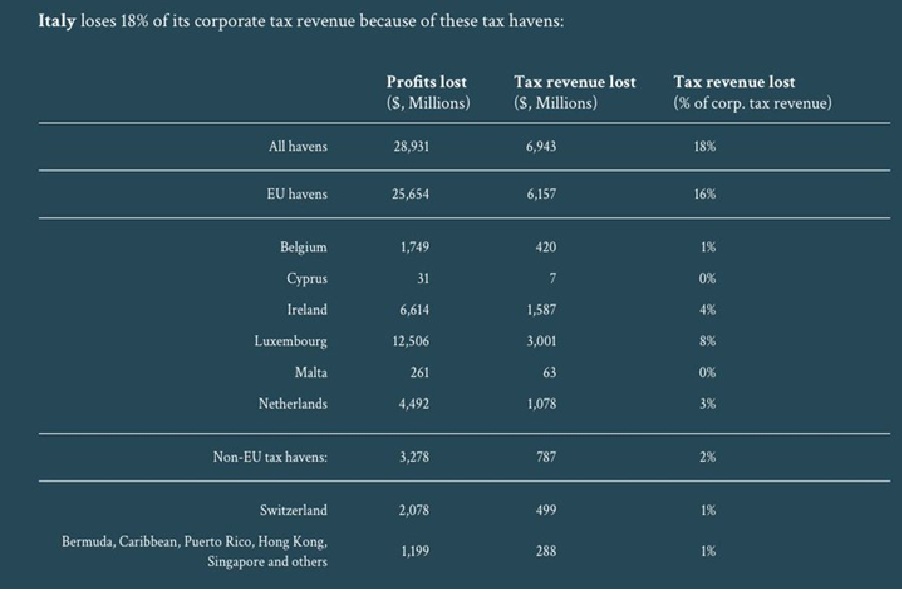

A more in-depth analysis of the numbers, presented in a recent study, shows that the total amount of lost profits is 28.931 million dollars, with a consequent loss of tax revenue for the Italian State of 6.943 million dollars. This is an enormous loss for a country that is struggling with a high public debt and the need to finance essential services such as healthcare, education, and infrastructure.

Most of this drain occurs within the European Union itself, which should, in theory, promote fair competition and fair taxation. Instead, EU tax havens are responsible for the loss of $25,654 million in profits and $6,157 million in tax revenue for Italy. Luxembourg and Ireland, with their aggressive tax policies, stand out as the main culprits of this hemorrhage, subtracting 8% and 4% of Italian tax revenue respectively. They are closely followed by the Netherlands, Belgium, Cyprus and Malta.

Non-EU tax havens also contribute to the problem, albeit to a lesser extent. Switzerland and a group of offshore territories, including Bermuda, the Caribbean, Puerto Rico, Hong Kong and Singapore, deprive Italy of a further 787 million dollars in tax revenue.

This bleak picture raises a crucial question: how can Italy stem this hemorrhage and recover the resources necessary for its development and the well-being of its citizens? The answer, however uncomfortable, is only one: to tackle the problem at its root, openly challenging the permissive fiscal policies of the EU and reclaiming its fiscal sovereignty.

The current European architecture, with its rules on the free movement of capital and its reluctance to impose a common and harmonized minimum taxation, in fact favors unfair tax competition among member states. Multinationals, free to choose the most convenient jurisdiction, take advantage of this, while countries with more onerous tax regimes, such as Italy, suffer the consequences.

To reverse this trend, Italy must adopt a position of strength within the EU, proposing radical reforms that limit downward tax competition and ensure fair and transparent taxation of multinationals. This could include the introduction of a Europe-wide minimum effective tax rate, a review of the rules on corporate tax residency, and stronger measures against tax avoidance.

If the EU proves deaf to these requests, Italy should seriously consider the option of reclaiming its fiscal sovereignty, adopting unilateral measures to protect its revenues and counter avoidance. This could mean introducing taxes on financial transactions with tax havens, tightening controls on capital flows or, as a last resort, renegotiating European treaties.

The challenge is difficult, but the stakes are too high to ignore it. Regaining fiscal sovereignty is not only a question of economic justice, but also of national dignity and the future of the country. Italy can no longer afford to be a victim of a system that penalizes it and undermines its prosperity. It is time to act, with courage and determination.