International

Truobles for Germany: business down and salaries up. A real record

How is the German economy doing? Bad, thank you. What are the expectations? What is the level of confidence toward the future? Very slowly improving, almost stationary.

That is how one can sum up the value of two anticipatory indices published today by the Zew research institute in Mannheim, which are the result of the usual monthly survey of a representative sample of German businesses. The negative surprise is that analysts’ expectations, which had been expecting better data, were disappointed.

These data are very important because the ECB cares about nothing, absolutely nothing, except Germany. Italy could go bankrupt, in Spain we could have bulls ravaging factories, Greece could sink into the sea, and the ECB would not care about anything. If unemployment in Germany grew by 1 percent, the ECB would drop interest by two points. Because there is no Europe, but there is Germany surrounded by a few colonies.

Of significance in this respect is the call by Germany’s largest union (IG Metall) to sit down in negotiations with industrialists demanding a 7 percent wage increase for 3.9 million workers, the backbone of German industry. After an 8 percent increase spread over two years and a one-time sum of 3,000 euros, wrested in negotiations closed in 2022.

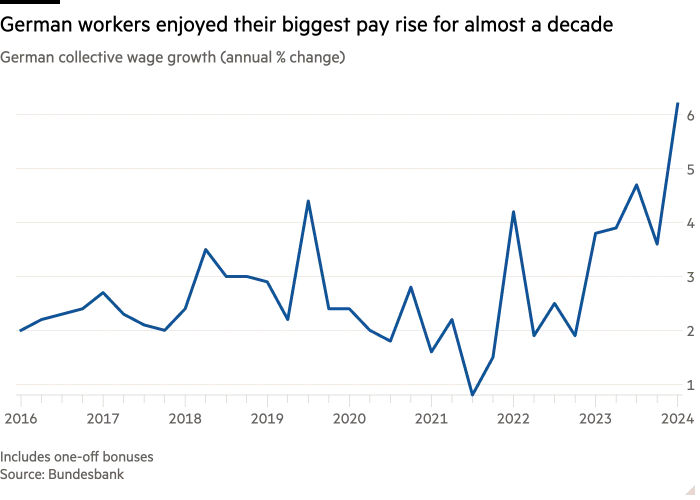

As a result, wages in Germany grew by 6.2 percent in the first quarter of 2024, compared to the first quarter of 2023. The highest growth of the decade which, however, does not compensate for the cumulative loss of purchasing power suffered due to inflation.

Line chart of German collective wage growth (annual % change) showing German workers enjoyed their biggest pay rise for almost a decade

Of course, the industrialists have responded frostily, and in September we will see what turn the negotiations will take.

Now the gaze is toward the Eurotower, which is keeping a very close watch on wage dynamics and waiting for nothing more than not to continue with the rate cut. Although they know very well in Frankfurt that much of the exceptional inflation in 2021-2023 is attributable to firms’ choice to pass on higher commodity and energy costs to prices, maintaining and sometimes improving margins.

So there should now be sufficient room to absorb those increases without restarting prices. Indeed, there may even be slight growth that could have limited effects even in other European countries.