Economy and business

China: prime interest rate remains stable. The problem of the Liquidity Trap

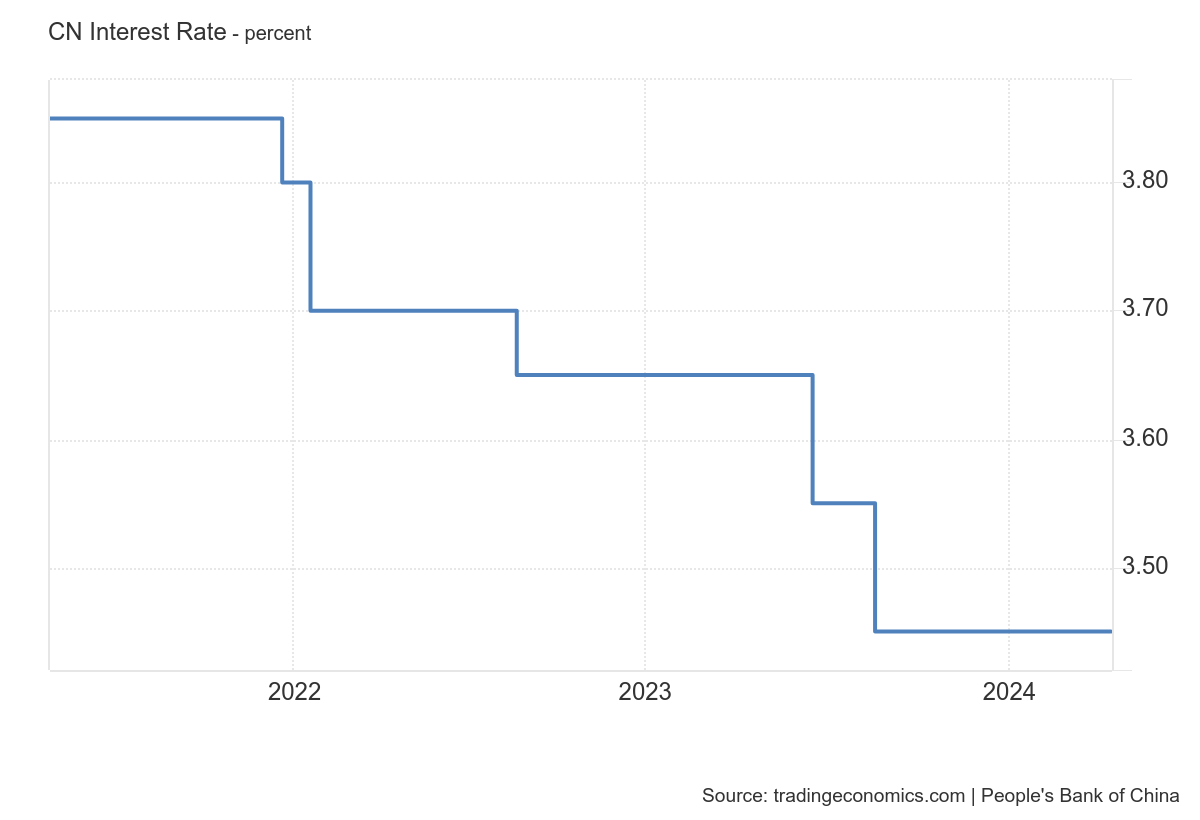

Todaythe PBOC decided to keep LPR rates, the Loan Prime Rate, the credit sector benchmark, unchanged. This one-year rate, the benchmark for much of the banking system, remained unchanged, and this is in line with market expectations Here is the related chart:

The five-year rate, which is usually the benchmark for mortgages, was also unchanged at 3.95 percent. The PBOC has decided not to go overboard with monetary stimulus, perhaps because it is realizing that, at this time, it is not as useful as fiscal stimulus.

A big deflation problem

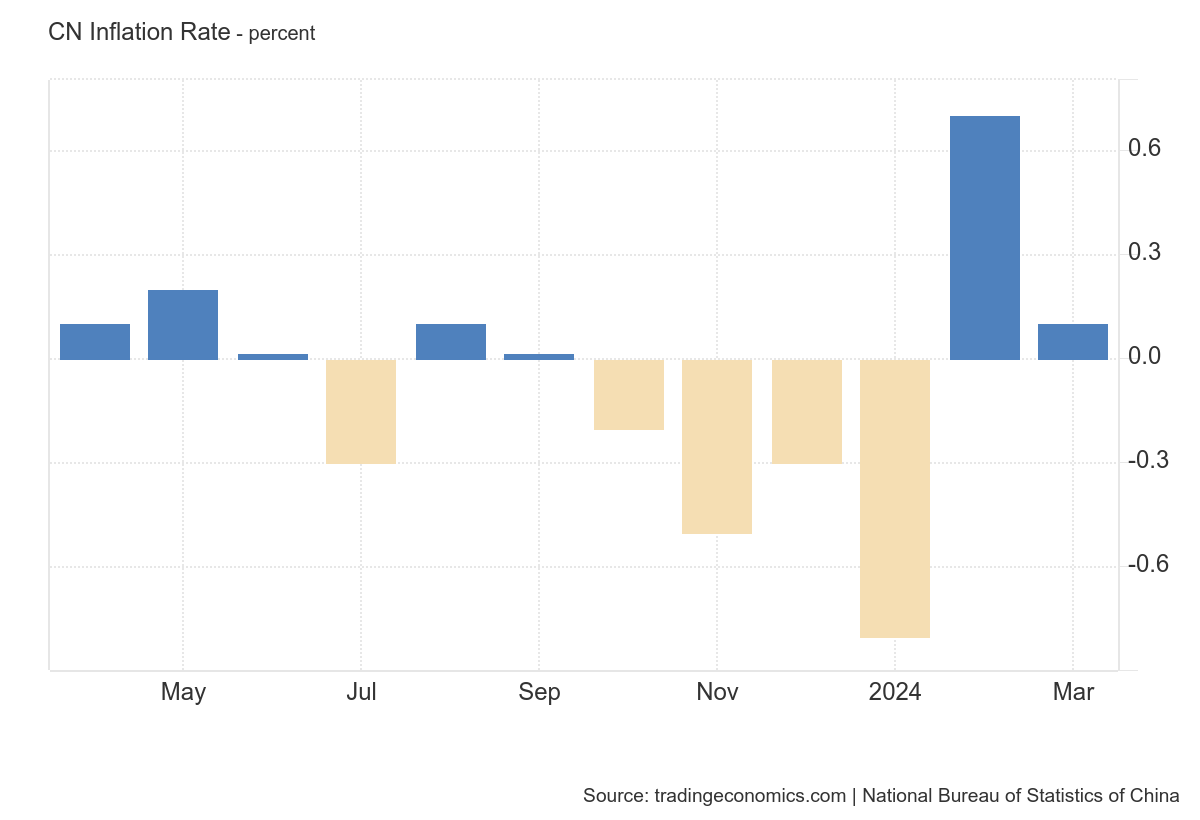

Now, if 3.45 percent does not sound like much for China, it is, in fact, a lot because consumer price inflation is currently very low; in March, it was 0.1 percent

For the past six months, the highest annual inflation rate has been 0.8 percent, so the rates set by the central bank are not only positive, they are strongly positive.

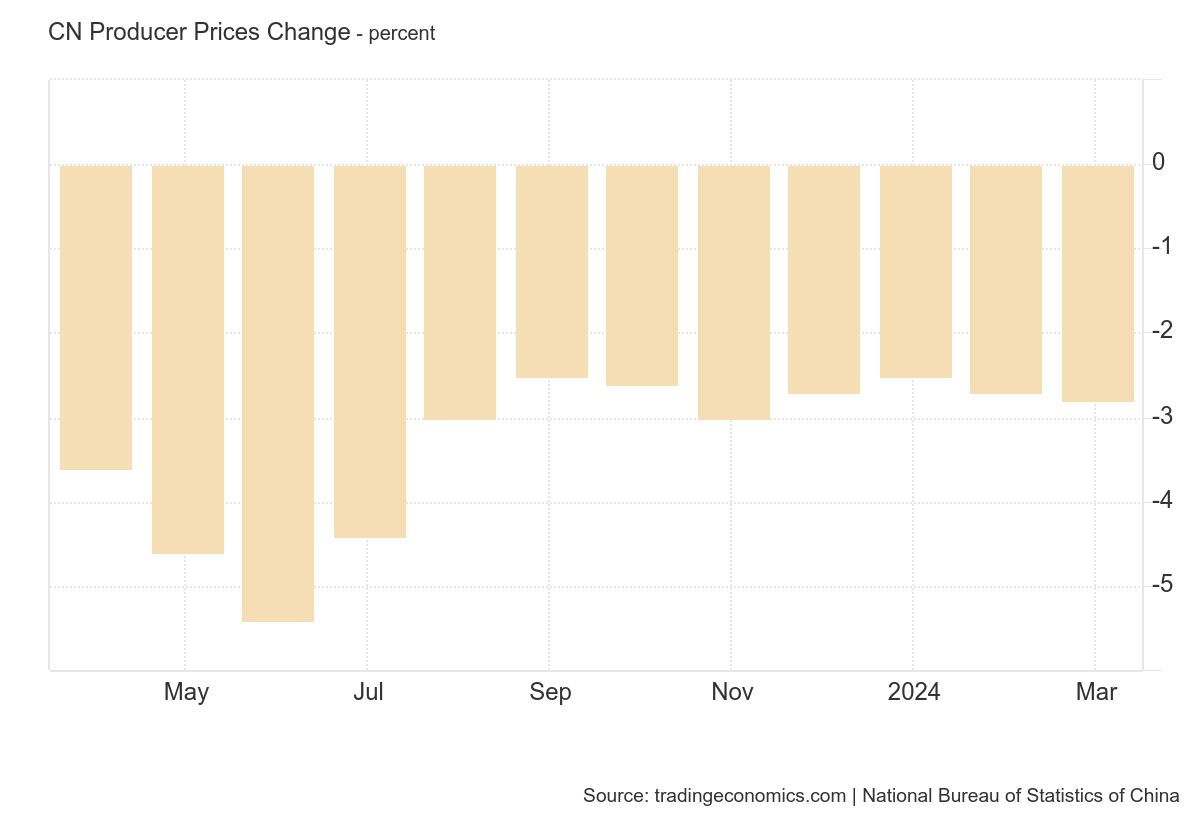

The production cost situation is even worse, indicating that, however, there is a demand problem and not an insignificant one. The reduction in producer prices cannot be explained only by increased efficiency but also by a cut in margins,and this will eventually lead to closures and layoffs

A lack of confidence fuels the liquidity trap

The problem is that the banking system is weighed down with insolvencies and securities with zero or near-zero valuation. Not to mention the various Evergrande and Country Garden cases, the value of mortgage defaults has increased by 43 percent and the number of assets seized by banks , including commercial real estate, has reached 793,000. However, a healthy bank is not a real estate developer and these numbers are worrisome. Even if the PBOC and the government guarantee the soundness of the credit system, resources are still being cut.

In this situation, the danger of a liquidity trap, that is, a situation in which resources injected into the banking system by the central bank and lent to consumers are not turned into consumption but are hoarded and remain unproductive, is very high. The Chinese are no longer buying apartments, which in any case have productive activity behind them, but gold, which is only a safe-haven good, does not stimulate the economy, and this also explains the recent rise in the price of the precious metal.

However, gold is, for the national economy, a disaster because it is the hoarding asset par excellence and the most productive one. A nation could own thousands of tons of gold, even at the popular level, and see starvation in the streets because gold develops economic activity marginally.

What the PBOC and the government could do

The solution to the problem is by no means simple. There are recipes, but they are far from certain in their results.

- Purchase of government bonds: The PBOC could increase the purchase of government bonds to increase liquidity and lower real interest rates. However, this would require coordination with the Ministry of Finance to increase debt sales, and then this debt would have to be well utilized. Otherwise, the liquidity would end up in the purchase of gold, that is, in an unproductive and hoarded investment

- Expansionary fiscal policies: The Chinese government could implement bolder fiscal stimulus measures to increase aggregate demand, but this could increase the deficit-to-GDP ratio. That is, the money raised from bond sales should be used for something useful and productive, not in infrastructure that is not needed, empty malls, ghost towns.

- Banking sector reforms: The PBOC could encourage banks to focus on the core business of lending and strengthen their balance sheets by improving financial supervision and risk management. This will not be easy.

- Measures to increase confidence: Improving transparency and communication by monetary and financial authorities could increase confidence in the system and encourage investment.

Challenges and unknowns:

The problem is that this is easier said than done. Making investments exactly as the PBOC would like requires a system of tracking and feedback to understand where the money is actually going.

It would also require the state to actually invest according to guidelines linked to economic, not political, objectives, correcting its priorities. It would then require increasing public confidence in the banking system to get money flowing back into productive investments. All steps that are not exactly simple. However, China must be able to overcome this impasse, even at the cost of setting aside some political priorities.