Economy and business

Disappointing Bayer challenged by shareholders

It’s looking bad in Bavaria, especially for the chemical giant based in this land. Bayer shareholders criticize Bill Anderson and his behavior since he took office last June during the annual general meeting. “Once again, we look back on a lost year,” says Ingo Speich of Deka Investment, according to the speech available in advance.

Speich, with Deka Investment, represents the voting rights of 4.5 million Bayer shares and is not the only dissatisfied shareholder. Janne Werning of Union Investment, who represents the voting rights of 5.8 million shares, also says the measures announced so far are not enough to solve Bayer’s problems. “Bayer is trapped in three ways,” he says.

Since the last general meeting, the share price has fallen by more than 50 percent. Bayer is currently worth less than 27 billion euros, less than half of what it paid to buy the Monsanto farm in 2018. Here is the graph of its stock value:

The deal with Monsanto and the legal risks involved are two of the biggest problems Bayer is still grappling with today. Fund manager Speich describes it as “a toxic mixture that is simmering and over which they currently have no control.”

To date, Bayer has spent €11.3 billion on litigation; €2.1 billion has been spent on lawsuits. This puts a strain on the company’s free cash flow. In 2023, it was 1.3 billion euros.

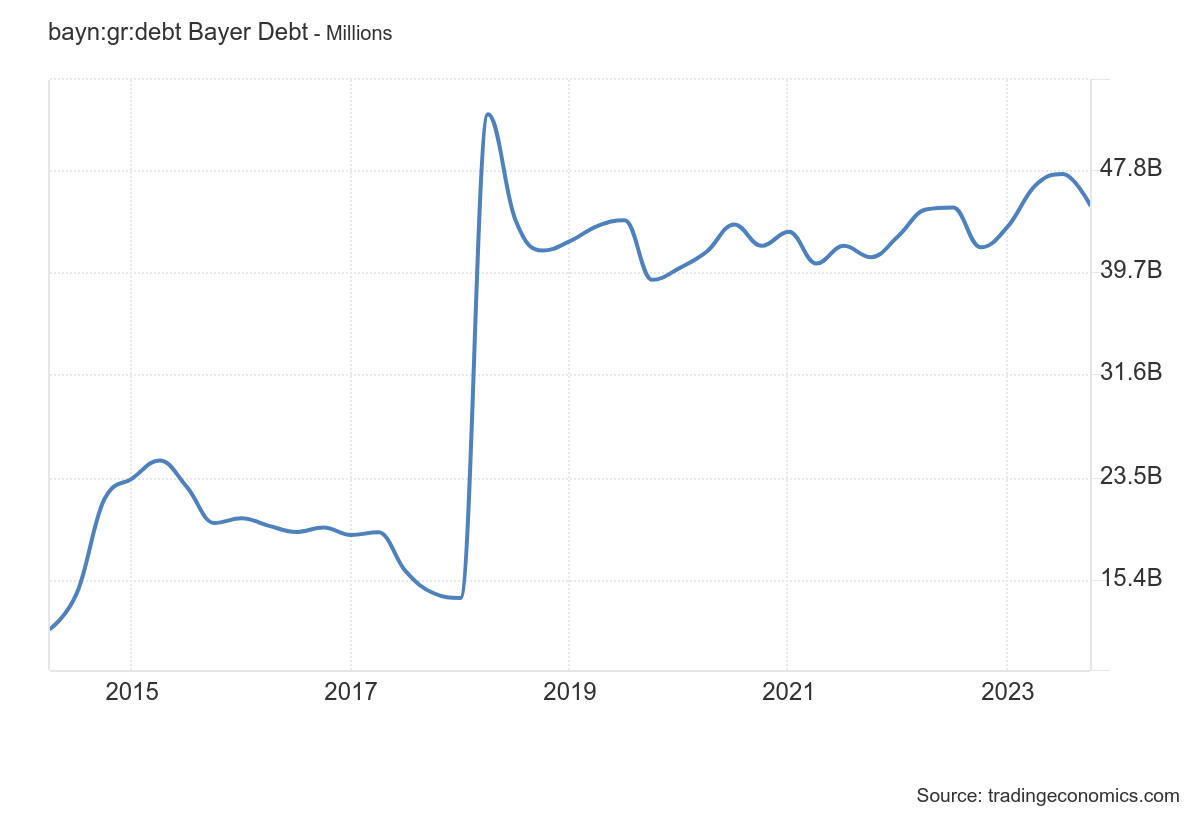

At the same time, Bayer’s debt has increased to 34.5 billion euros. This puts the company under pressure. Bayer’s high debt-to-GDP ratio puts its credit rating at risk. However, there is no money from free cash flow to reduce debt. Here you can see Bayer’s debt evolution

There is also a lack of money for investments that Bayer could use to specifically strengthen the pharmaceutical pipeline. This is urgently needed. Patents on the two biggest revenue generators to date, the anticoagulant Xarelto and the eye drug Eylea, will expire soon, so Bayer needs drugs that will yield billions in the future.

The stroke drug Asundexian, which was supposed to generate maximum sales of five billion euros, failed in a major study last year. Union Investment’s Werning calls it a “serious setback.”

Bill Anderson is aware of the problems, but he is also trying to buy time for shareholders: “It’s not going to be a quick fix within a year, and there will be difficult times ahead,” he told the general meeting. His goal is to reduce net debt to 32.5–33.5 billion euros in 2024 and increase free cash flow to 2–3 billion euros.

The road to healing

To do this, he wants to strengthen the pharmaceuticals and agrochemicals divisions with further innovations, find new strategies to handle glyphosate, and make Bayer more efficient with a new organizational model, thus saving two billion euros in personnel costs starting in 2026.

For investors, this is not happening fast enough: “Bayer’s house is on fire and you, as a landlord, instead of putting out fires, start cleaning up,” criticizes Deka’s Speich fund manager. “We expect a much stronger focus on reducing legal risks, improving the pharmaceutical pipeline, and a stronger agricultural business.”