Economy and business

Fed Indicates Three Rate Cuts in 2024

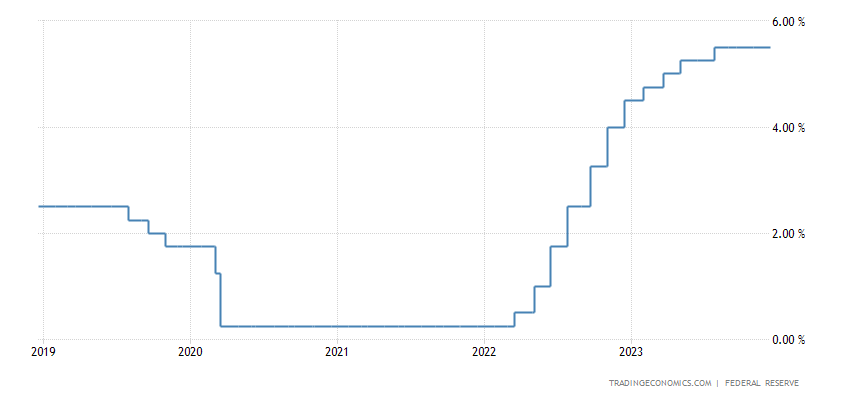

The Federal Reserve held the federal funds rate steady at 5.25 to 5.5 percent for the third consecutive meeting in December 2023, in line with expectations, but indicated cuts of 75 basis points in 2024. Here is the related chart:

Economists said recent indicators suggest that economic growth has slowed, demand for jobs is sustained, and the unemployment rate has remained low. Inflation has eased over the past year but remains high, especially core, which is above the Fed’s targets.

The central bank also released new projections. GDP growth is expected to be higher this year (2.6 percent versus 2.1 percent in the September projection) but slightly lower in 2024 (1.4 percent versus 1.5 percent). In addition, PCE inflation was revised downward for both 2023 (2.8% vs. 3.3%) and 2024 (2.4% vs. 2.5%), as well as core PCE inflation, which is projected at 3.2% in 2023 (vs. 3.7%) and 2.4% (vs. 2.6%) next year. Unemployment projections remained stable at 3.8% for 2023 and 4.1% next year.

The so-called dot plot shows that the median projection of the federal funds rate for the end of the year 2024 has dropped to 4.6 percent from the 5.1 percent observed in September. This comes to indicate a drop of 0.9 percent, or about three interest rate cuts in 2024.

The market immediately weighed the announcement with a sharp drop in bond yields. Here is the one for U.S. two-year notes.

The stock market responded positively, but it had already predicted this trend in recent days, so today’s rise was relative. We will see if this rise in stock market values continues in the coming days or if the momentum has worn off.

By now, however, the FED seems to have laid its cards on the table for 2024. What will the ECB do?