Economy and business

Germany: economic indicators are lackluster for 2024. It won’t be a good year

There is little joy in Germany, and not only because of farmers’ protests, which are as active as in France but hidden by the media. The economic news is also not positive, indeed, hinting at a gray future.

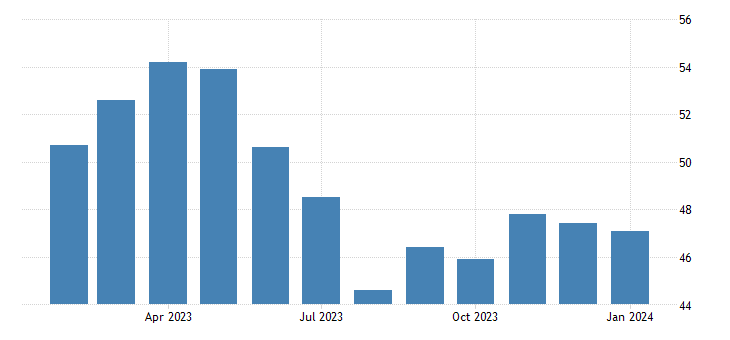

First of all, the indicator, the HCOB Germany Composite PMI, fell to 47.1 in January 2024, down from 47.4 in the previous month and below the market consensus of 47.8, according to a preliminary estimate. Business activity fell for the seventh consecutive month and at the fastest pace since last October, with manufacturing output contracting the most in eight months and services activity falling at the fastest pace since August.

Recall that below 50, the indicator shows contraction, and here we are in a contraction that is beginning to be noticeable in the private economy.

This lackluster performance of the German economy is confirmed by the IFO forecast,which cuts growth for the German economy and attributes this explicitly to the austerity measures of the federal government. Researchers in Munich predicted Wednesday that gross domestic product is likely to grow by only 0.7 percent this year.

In mid-December, they still expected a 0.9 percent increase. Last year, Europe’s largest economy contracted by 0.3 percent.

“According to our estimate, with the federal budget now agreed in the budget committee, additional savings of nearly 19 billion euros have been decided,” said Ifo chief economist Timo Wollmershäuser, explaining the new forecast. “Businesses and households will be more or less burdened, and government spending will be cut.”

However, there are economists who have an even worse view of Berlin’s economy in 2024. The Institute for Macroeconomics and Economic Research (IMK), affiliated with the German trade unions, predicts another 0.3 percent contraction this year. “There is only hope for an economic recovery toward the second half of the year, when rising wages and further declining inflation will support the purchasing power of private households,” said IMK scientific director Sebastian Dullien.

At present, the forecast of a contraction is more likely to come true than that of a moderate expansion, and this is because of the combination between the ECB’s restrictive policy and the Scholz government’s austere fiscal policy. All this in a year of important election appointments. Politics will not be able to ignore this situation