Economy and business

Germany increases carbon taxes on fuels in 2024, waiting to increase more in 2025.

Germany is wishing its citizens a happy new year with a nice increase in the prices of fuel and many energy products linked to an increase in the carbon tax on CO2 emissions. The decision was made last June to raise the carbon tax on trucking and domestic use to 45 euros per ton of CO2, with plans to rise to 50 euros per ton in 2025.

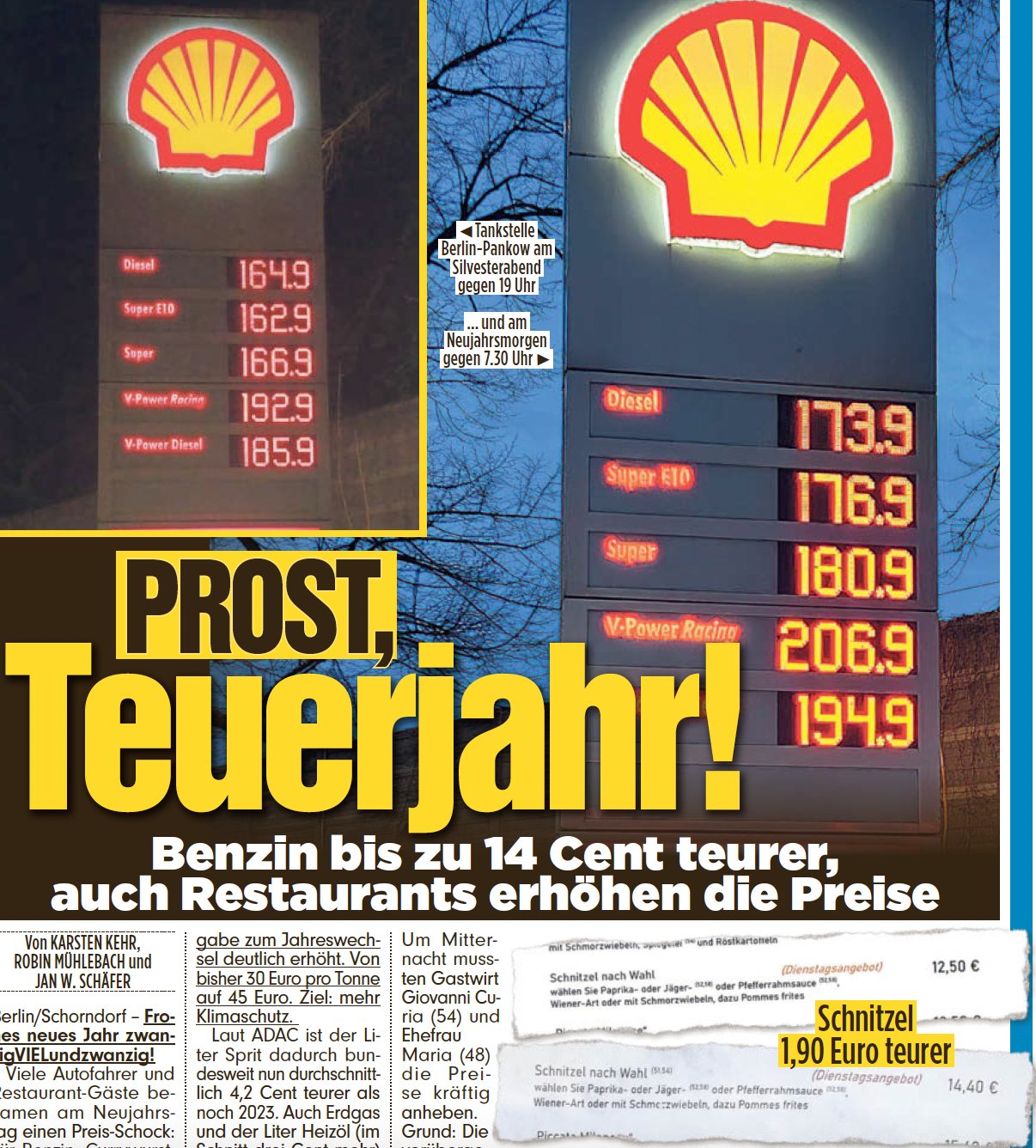

The increase in fuels was, according to the German motorists’ association, about 1.6 cents per liter for gasoline and 4.6 cents per liter for diesel, although it seems that the increases are higher at many pumps, reaching as high as 10 cents with peaks of 14 cents, as reported by some newspapers.

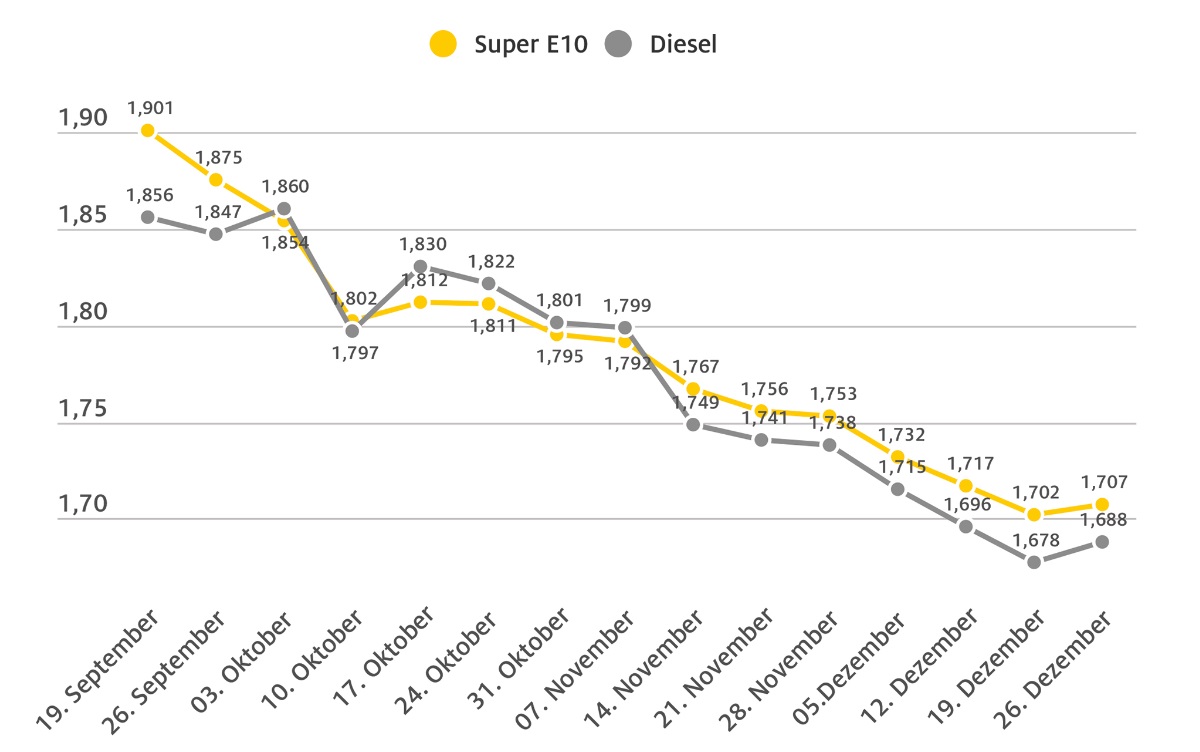

What seems to be the case is that the increases were brought forward from the introduction of the tax increases and coincided with an increase due to the trend in international fuel prices, as well as some cunning on the part of pump operators. As early as December 26, prices were rising after months of decline.

The increase in this tax will likely lead to an inflationary flare-up that will be felt in the January 2024 figures. Thus, let us remember that if German inflation rises during this period, it will not be because of an economic awakening but because of the effect of external factors multiplied by domestic fiscal decisions.

The government has made available to commuters a mileage relief deduction to be obtained in their tax returns. Commuters can report the cost of their commute to work on their tax returns and thus get 30 cents for the first 20 kilometers and 38 cents for the 21st kilometer traveled. A complicated system comes to add to the bureaucracy faced by the citizen. It is an unsatisfactory solution, but the German government is in the hands of the Social Democrats and Greens, who evidently want to use these funds for their energy transition. And the German citizen just has to pay.