Economy and business

Inflation in US: the reduction is too slow. Fed probably won’t reduce rates yet

US inflation falls again. The headline CPI in the US is expected to have stabilised on a monthly basis due to lower energy prices, with the annual figure rising from 3.2% to 3.1% in November. While all components, except for housing, are pointing to only +1.4%, housing is leading the price trend upward.

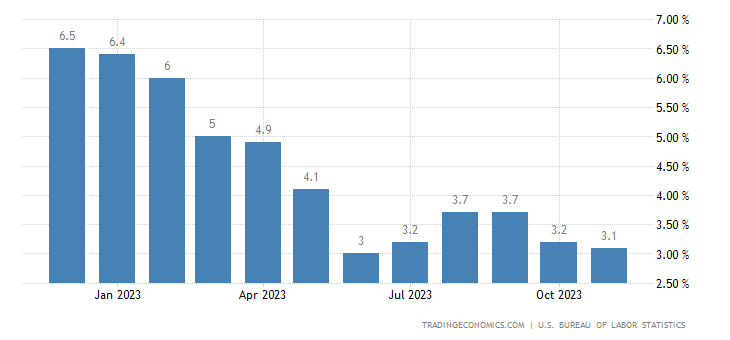

Core inflation is seen stuck at 4%, still high for the FED’s decision-makers, and remains double the FED’s target. These numbers certainly look better than in 2022, when US core inflation reached 6.6 percent and also remained slightly above market expectations of 3 percent. As Fed Chairman Powell will undoubtedly say tomorrow, progress in the Fed’s fight against inflation is encouraging, but the job is not yet done. In the meantime, let’s look at the short-term inflation charts:

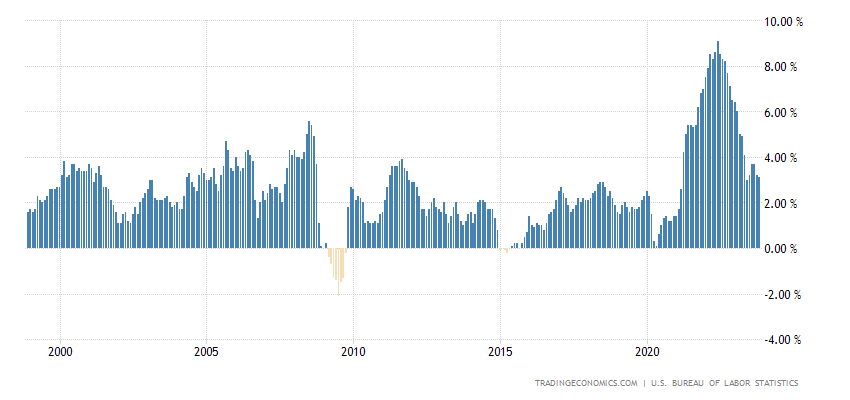

On a 25-year horizon

Here is the core inflation figure, unchanged, and this fact won’t make FED very happy

Since the entire tightening of monetary policy is aimed at fighting inflation, a series of softer-than-expected inflation data could give further impetus to the Fed’s ‘doves’, but much will also depend on the labour data, and, in any case, we will know tomorrow what the board thinks.

Although the Fed is happy with the current results—decreasing inflation despite a healthy easing in the labour market and fairly resilient growth—Powell will not talk about the success achieved on inflation, at least this week. As we said, the labour results are positive, and core inflation, influenced by wages, is still at last month’s levels and has not fallen. Therefore, the Fed is likely to be satisfied but cautious, regardless of what we see in the inflation data today.