Economy and business

Nearly 50,000 British businesses are in “critical” financial distress. A really worrying record

Nearly 50,000 British businesses are in “critical” financial distress as high financing costs and exploding operating expenditures squeeze them, according to data compiled by a company specializing in corporate insolvency management.

The latest Red Flag Alert by insolvency specialist Begbies Traynor found that, across the economy, the number of businesses in “critical” situations was 47,477 in the fourth quarter, up 26 percent from the previous quarter. The third quarter saw a 25 percent increase over the previous period

Begbies Traynor said a “significant percentage” of the companies it identifies as being in “critical” financial distress will become insolvent over the next year.

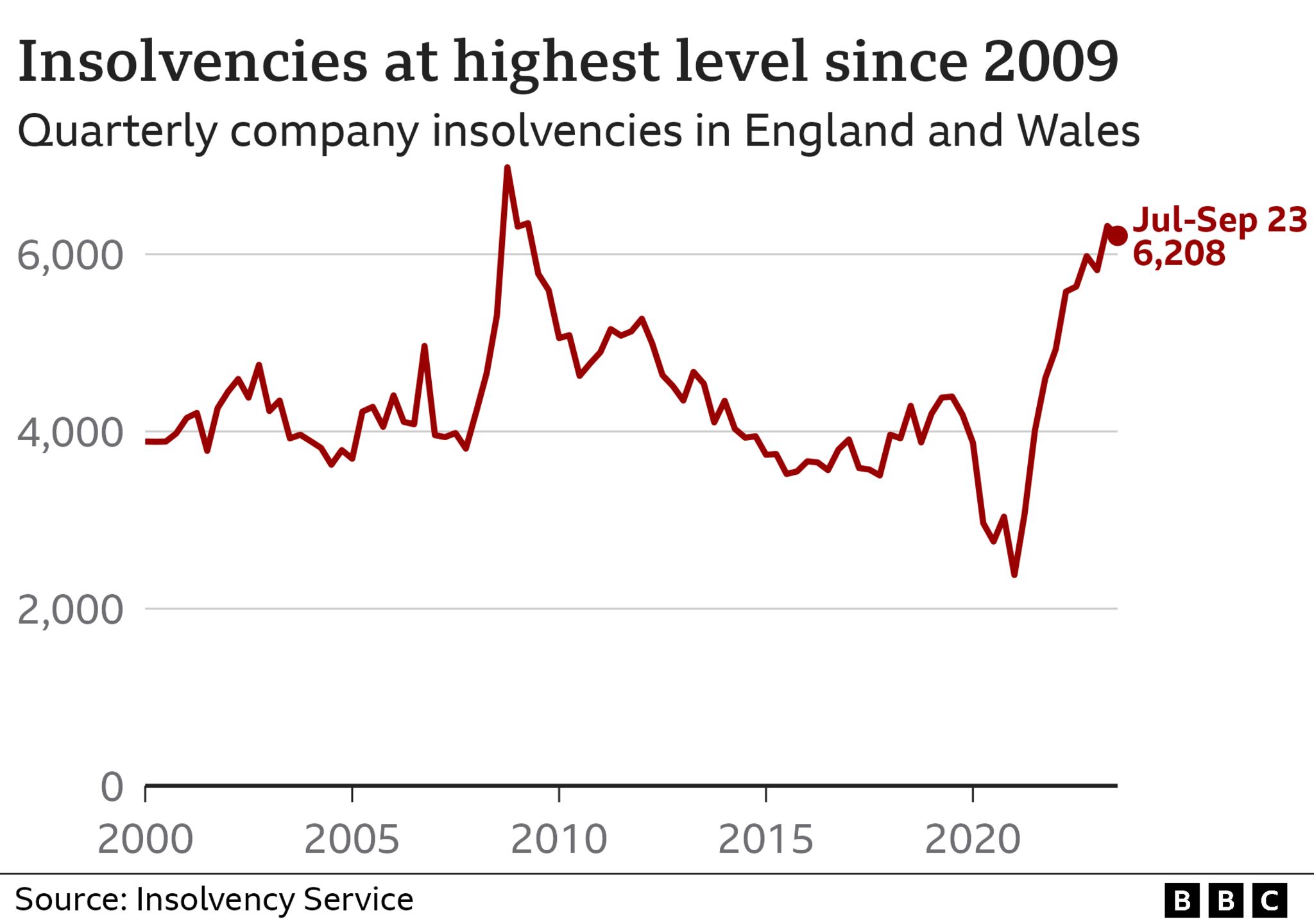

According to government data, the number of bankrupt companies last year reached the highest level since the 2009 financial crisis, with a 10 percent year-on-year increase in bankruptcies in the third quarter.

Last week, markets were spooked by a double whammy: higher-than-expected inflation in December and bad retail sales data that showed the UK is on the brink of a technical recession.

The number of businesses in “significant” financial difficulty rose 13 percent in the last quarter. More than half a million businesses (539,900) will be affected by the end of 2023.

Begbies Traynor said the key sectors driving the increase in financial distress continue to be construction, real estate, support services, healthcare, and education.

“Now that the era of cheap money is definitely a thing of the past, hundreds of thousands of U.K. businesses, which hoarded affordable debt during those happy days, are now facing the additional burden this will place on their finances,” said Julie Palmer, partner at Begbies Traynor.

“Unfortunately, for tens of thousands of British businesses that should be looking forward to 2024 with some degree of optimism, the new year will bring with it a struggle for survival as the debt storm that has been brewing for years appears to be brewing across the country.”

Ric Traynor, executive chairman of Begbies Traynor, added, “Over the course of this year, we may see some respite for businesses as inflation looks likely to reach more palatable levels, which, in turn, should cause interest rates to begin to fall from their current high levels.

“Unfortunately, there are no signs of an easy solution, and with geopolitical uncertainty continuing to grow and a national wage hike around the corner, the scenario is hardly improved for an economy that is still firmly in post-pandemic recovery mode.”

Telegram