Economy and business

Saudi Arabia: non-oil revenues will reach 50 percent of the Kingdom’s GDP

Saudi Arabia, one of the world’s great oil producers and a leader in OPEC, has always been known for its economy’s dependence on heptroleum exports and their prices, but, at last, it seems that the country is beginning to break away from its past. It seems that the Saudi “Vision 2030” program is already bearing fruit, and Riyadh may not feel the brunt of these cuts as many feared. Saudi Arabia’s Ministry of Economy and Planning revealed that non-oil revenues will reach 50 percent of the Kingdom’s Gross Domestic Product (GDP) in 2023, the highest level ever.

The country’s non-oil economy has been valued at 1.7 trillion Saudi Riyals (about US$453 billion) at constant prices, thanks to steady growth in exports, investment, and consumer spending. Last year, the Kingdom’s private sector investment grew by an exciting 57 percent to a record 959 billion Saudi Riyals (US$254 billion), while exports of arts and entertainment and real services grew by triple digits, 106 percent and 319 percent, respectively, reflecting the Kingdom’s transformation into a global destination for tourism and entertainment.

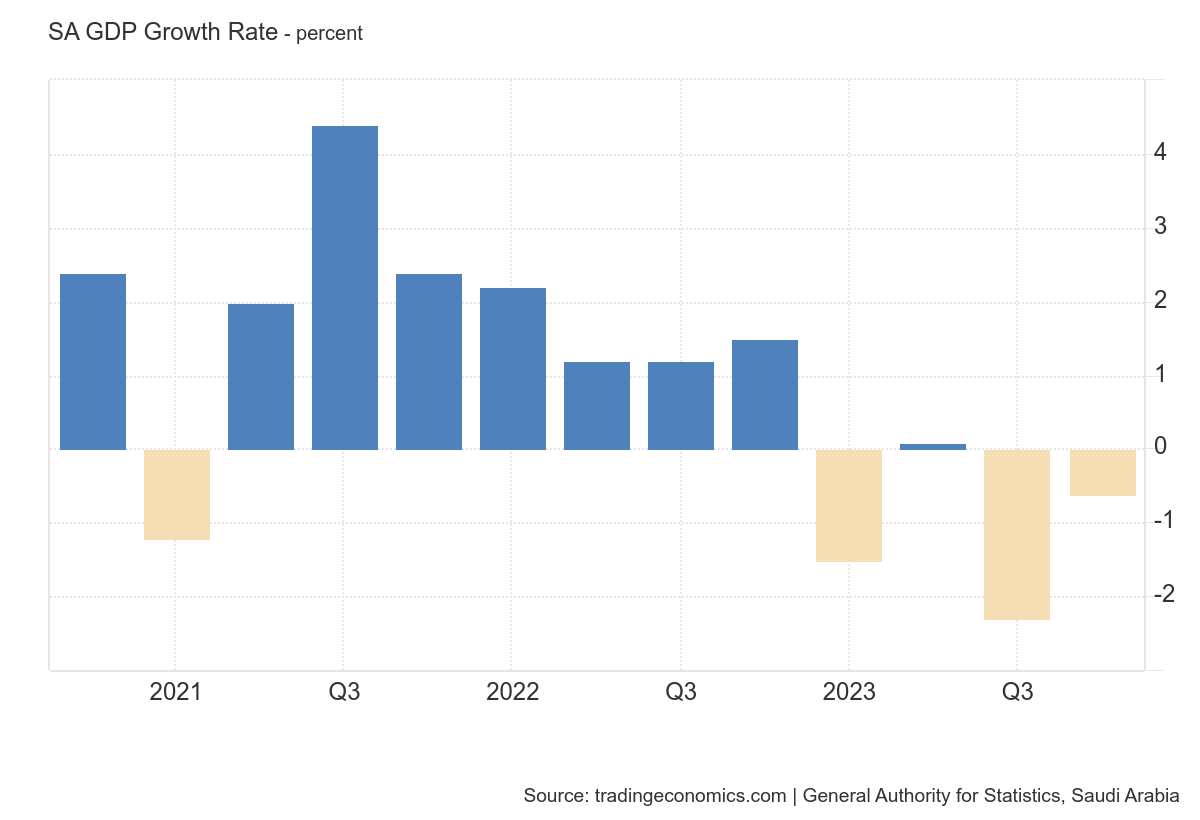

We have to say that, however , Saudi Arabia’s GDP Growth has been lackluster due to oil prices and Saudi Arabia’s oil production cuts

Saudi Arabia’s GDP Growth Rate

Meanwhile, the food sector grew 77 percent; transportation and warehousing services grew 29 percent; health and education grew 10.8 percent; trade, restaurants, and hotels grew 7 percent; and transportation and communications grew 3.7 percent.

The least bright sectors are those most dependent on tourism, perhaps the least successful bet for the Saudi government.

Diversification is paying off

Three years ago, Saudi Arabia’s Crown Prince Mohammed bin Salman unveiled Saudi Vision 2030, the Kingdom’s ambitious roadmap for economic diversification, global engagement, and improved quality of life. The main goal of the vision is to diversify Saudi Arabia’s economy and create dynamic job opportunities for its citizens through the privatization of state-owned assets, including the partial IPO of Saudi Aramco; unlocking underdeveloped industries such as renewable energy, manufacturing, and tourism; and modernizing the curriculum and standards of Saudi educational institutions from preschool to higher education.

In its economic plan, Saudi Arabia has set a goal of developing ~60 GW of renewable energy capacity by 2030, multiples of the country’s current installed capacity of only 2.8 GW and comparable to ~80 GW of gas or oil-fired power plants. With its constant Red Sea breezes and sun-scorched expanses, Saudi Arabia is indeed a prime ground for renewable energy generation. Meanwhile, Saudi Aramco has announced plans to spend $110 billion over the next two years to develop the Jafurah gas field, which is estimated to contain 200 trillion cubic feet of gas. The gas will then be converted into a much cleaner fuel, blue hydrogen.

The Saudi government is also building a $5 billion green hydrogen plant that will power the planned megacity of Neom. Called Helios Green Fuels, the hydrogen plant will use solar and wind power to generate 4 GW of clean energy that will be used to generate green hydrogen.

Last year, Aramco made the world’s first shipment of blue ammonia from Saudi Arabia to Japan. Japan is looking for reliable hydrogen suppliers, with Saudi Arabia and Australia on its shortlist.

But it is not only Saudi Arabia that is succeeding with its economic diversification. Last year, the World Bank released the World Bank Gulf Economic Update (GEU), which states that diversification efforts in the Gulf Cooperation Council (GCC) region are paying off.

“The region has shown remarkable improvements in the performance of non-oil sectors, despite the decline in oil production during most of 2023. Diversification and development of non-oil sectors are having a positive impact on creating job opportunities across all sectors and geographic regions in the GCC,” said Khaled Alhmoud, Senior Economist at the World Bank.

The World Bank estimates GCC GDP to grow by 1 percent in 2023, with weaker performance mainly due to a reduction in oil sector activity, which contracted by 3.9 percent to reflect successive OPEC+ production cuts and the global economic slowdown. Fortunately, the region will see economic activity recover to grow at 3.6 percent and 3.7 percent in 2024 and 2025, respectively. According to the World Bank, the reduction in GCC oil sector activity will be offset by the non-oil sectors, which are expected to grow by 3.9 percent in 2023 and 3.4 percent in the medium term, thanks to accommodative fiscal policy, strategic fixed investment, and sustained private consumption.

Obviously, this diversification is possible because underlying it are huge oil resources, without which the huge investments in alternative energies would not have been possible. At the same time, however, the real test will come with time: how many of these investments will maintain their profitability even in a future environment that is much more competitive on green energy? vate consumption.