Economy and business

Signa scandal and bankrupcy spread to Switzerland: Julius Baer’s CEO leaves

Swiss private bank Julius Baer draws consequences from its involvement in René Benko’s real estate empire: Chief Executive Officer Philipp Rickenbacher is to leave the bank; the director will be replaced on an interim basis by Deputy Director and Chief Operating Officer (COO) Nic Dreckmann.

The bank is also cancelling 586 million Swiss francs (about 628 million euros) in loans Julius Baer had granted to several Signa Group companies. Julius Baer announced this on Thursday while presenting its annual figures. David Nicol, head of the board’s risk committee, will no longer stand at the next general meeting.

In addition, the bank will cancel the bonuses of managers involved on the board of directors and board of trustees. To save costs, 250 jobs will also be eliminated. Romeo Lacher, chairman of Julius Baer’s board of directors, said, “We take full responsibility for the losses.” However, this is a singular event. In view of the change in leadership and the waiver of bonuses, Lacher added. “We are drawing a clear line in the sand.”

The value adjustment significantly reduces the bank’s annual profit: group profit drops 52 percent to 454 million francs. Analysts had expected a profit of about 800 million francs—many of them expecting a write-down of Signa’s loans by another 300 million francs after Julius Baer had already set aside another 70 million for the commitment at the end of November last year.

Julius Baer’s Asset manager admits credit risk of 606 million francs

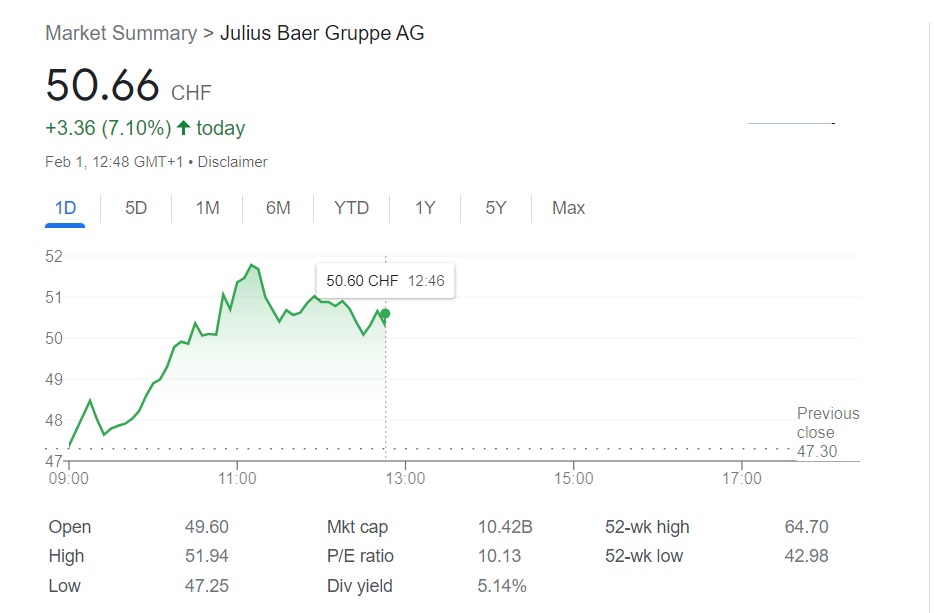

The fact that Julius Baer is writing off loans completely comes as a surprise to many investors. Shareholders received the news in a positive way and stock value increased on Thursday:

Daniel Bosshard, an analyst at Luzerner Kantonalbank, was also pleased with the impact on staff. But this transition should have taken place much earlier. “The damage to its reputation is immense because the institution has always presented itself as a purely private bank.”

The losses occurred in a business sector called “private debt,” in which Julius Baer offers complex structured loans to extremely wealthy clients. These can be secured, for example, with future cash flows from real estate or shares in unlisted companies. Lacher said, “On behalf of the entire board of directors, I express my deep regret that the full write-down of the largest exposure in our private debt business has had a significant impact on our consolidated profit for 2023.”

CEO and board of directors approved loans to Signa

Recently, the entire loan portfolio of the private debt business amounted to 1.5 billion francs. Loans granted in three tranches to Signa Group companies were by far the largest item and were approved by both the CEO and the board of directors. The purpose of the write-down is to “remove any uncertainty about the private debt business,” Lacher continued.

Julius Baer now wants to liquidate this business completely. “We are concentrating our lending in more traditional areas, which are an important part of our asset management offering,” said the chief regulator. These include mortgages or loans secured by securities, so-called lombard loans.

This is likely to have long-term consequences, expects Andreas Venditti, an analyst at Vontobel. “The decision to liquidate the entire private debt business is likely to have an impact on margins and profits.”

Even without the Signa disaster, Julius Baer’s year was disappointing: profit adjusted for impairments fell 10 percent to 947 million francs. Assets under management rose 1 percent to 427 billion francs. According to Vontobel analyst Venditti, growth in assets under management was well below expectations.