Economy and business

The US grows steadily, better than forecast, but will this trend go on?

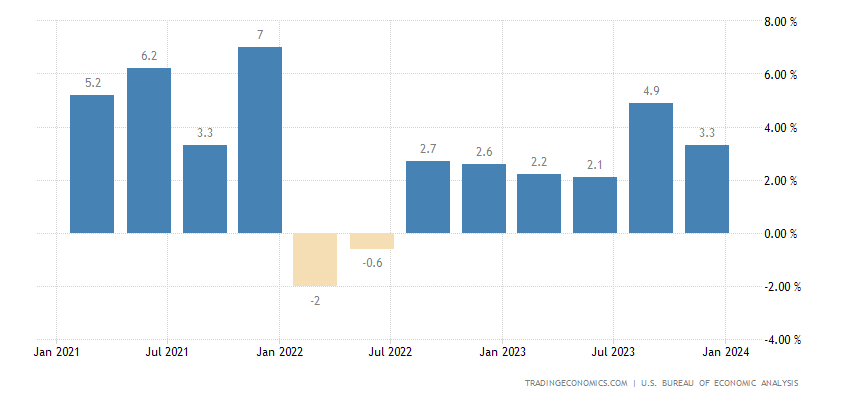

The year 2023 for the U.S. ends on a positive note. In the end, the dreaded “landing” did not happen. Even for a public component of growth that was nonetheless positive, U.S. GDP closed 2023 in the positive sector, and not by a small margin.

The star-studded economy expanded 3.3 percent year-on-year in Q4 2023, much better than forecasts of a 2 percent increase and after a 4.9 percent rate in Q3, according to the advance estimate.

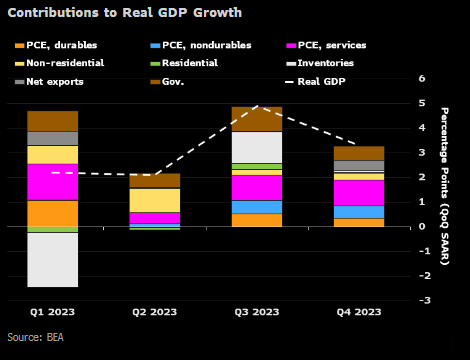

Consumer spending slowed (2.8 percent vs. 3.1 percent in Q3), led by goods (3.8 percent vs. 4.9 percent), while consumption of services increased faster (2.4 percent vs. 2.2 percent), led by food, accommodation, and health care services.

In addition, private stocks added only 0.07 percentage points to growth, compared to 1.27 percentage points in the third quarter, a sign that businesses do not expect activity to increase, and government spending increased at a slower pace (3.3 percent vs. 5.8 percent).

On the other hand, exports accelerated (6.3 percent vs. 5.4 percent) and imports grew less (1.9 percent vs. 4.2 percent), and this is important in rebalancing the trade balance, the weak point of the U.S. economy.

Looking further, nonresidential investment increased more (1.9% vs. 1.4%), led by a rebound in equipment (1% vs. -4.4%) and an increase in intellectual property products (2.1% vs. 1.8%), while investment in structures declined (3.2% vs. 11.2%).

Finally, residential investment continued to grow, although at a slower pace. Looking at 2023 as a whole, the U.S. economy grew by 2.5 percent, compared to 1.9 percent in 2022 and Fed estimates of 2.6 percent.

Here is the related graph:

If we analyze by component, consumption and government spending lead the way:

Economists and policymakers believed it would take a period of below-trend growth to make progress on inflation. Instead, above-trend growth in 2023 coincided with a sharp decline in inflation, reflecting the economy’s improving supply potential and the fact that inflation was caused by an external shock.

On the plus side, the U.S. has growth potential that the EU dreams of; on the downside, however, both employment and demand need to be closely watched. The not-so-high investment is a bit of a sign that there is no strong hope that the consumption trend will remain upward for a long time.

In Europe, though, we can only dream about the U.S. economic data. We are in another world.