Economy and business

The Yen touches lows not seen in almost 40 years. What will happen now?

The Japanese Yen has depreciated towards 152 per dollar, hitting a new one-year low, as investors brace for U.S. inflation data and further comments from Federal Reserve officials this week.

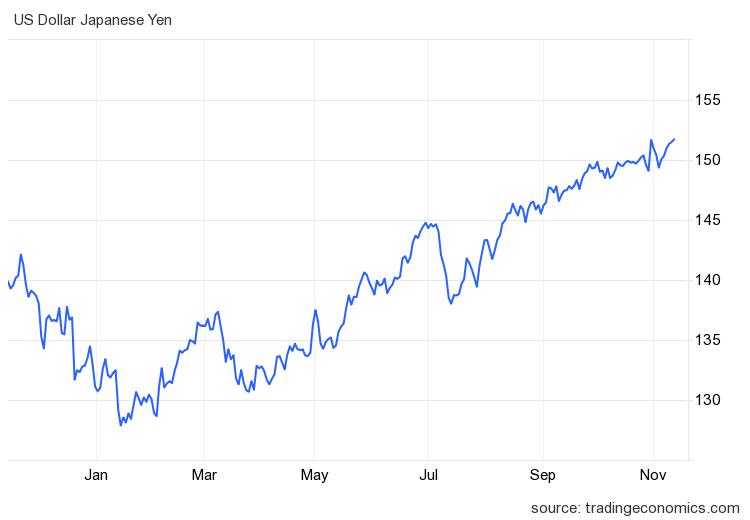

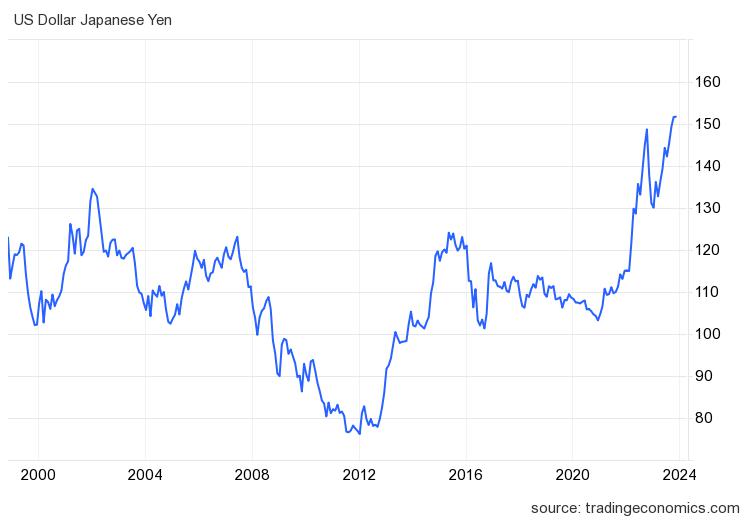

Indeed, as evidenced by the charts, the Yen hasn’t been this weak against the USD in practically 39 years. We have to go back to the roaring eighties to see a Dollar this strong. here the charts with one year, 25 year and 50 years horizon

USD JPY 1 year

Last week, the assertive monetary messages from U.S. policymakers weighed on the markets, with Fed Chair Jerome Powell stating that the central bank is “not confident” it has done enough to curb inflation, thus not ruling out further hikes.

This stands in stark contrast to the Bank of Japan’s commitment to patiently maintain an accommodative monetary stance. Meanwhile, BOJ Governor Kazuo Ueda stated that the central bank must proceed with caution due to abundant uncertainties. A rather cautious outlook, showcasing the quality of the preparation, even academically, of Japanese officials.

He also acknowledged that the growing policy divergence has led to the currency’s weakness but did not make direct statements in support of the Yen. Earlier this month, the BOJ redefined 1% as an “upper limit” rather than a strict threshold for 10-year JGBs and eliminated the commitment to defend the level with unlimited bond purchases. This implies that we might see Japanese 10-year bonds surpass the 1% yield for brief periods.

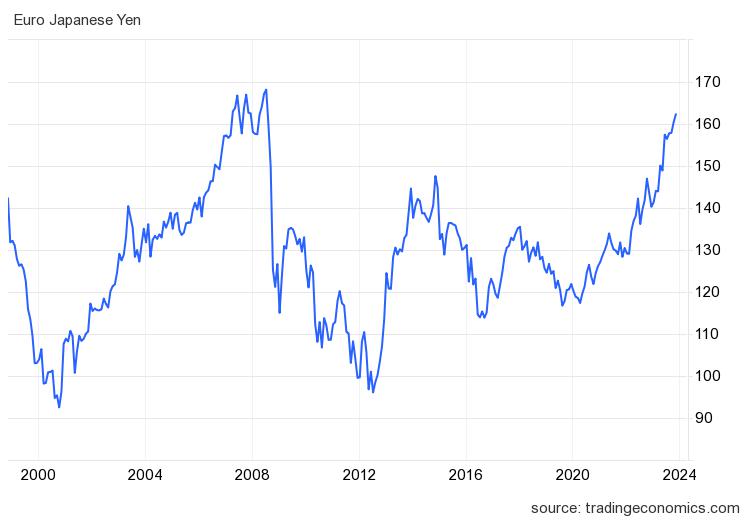

The Yen has also weakened against the Euro, although the record against the European currency is less pronounced, as depicted in the following chart:

What does this mean for the Japanese economy? First and foremost, there is a risk of rising inflation for two reasons:

- The effect of imported inflation due to commodities and energy, of which Japan is a significant importer, could impact domestic prices. Oil, natural gas, iron, copper—all commodities quoted in dollars.

- The devaluation against the Dollar and Euro makes Japanese products more competitive against competitors, especially sophisticated products stemming from an advanced economy. This will lead to an increased demand for industrial goods, an overheating economy, and a rise in inflation.

We await the upcoming data.