Economy and business

Turkish inflation is at 68%, but things are not that bad

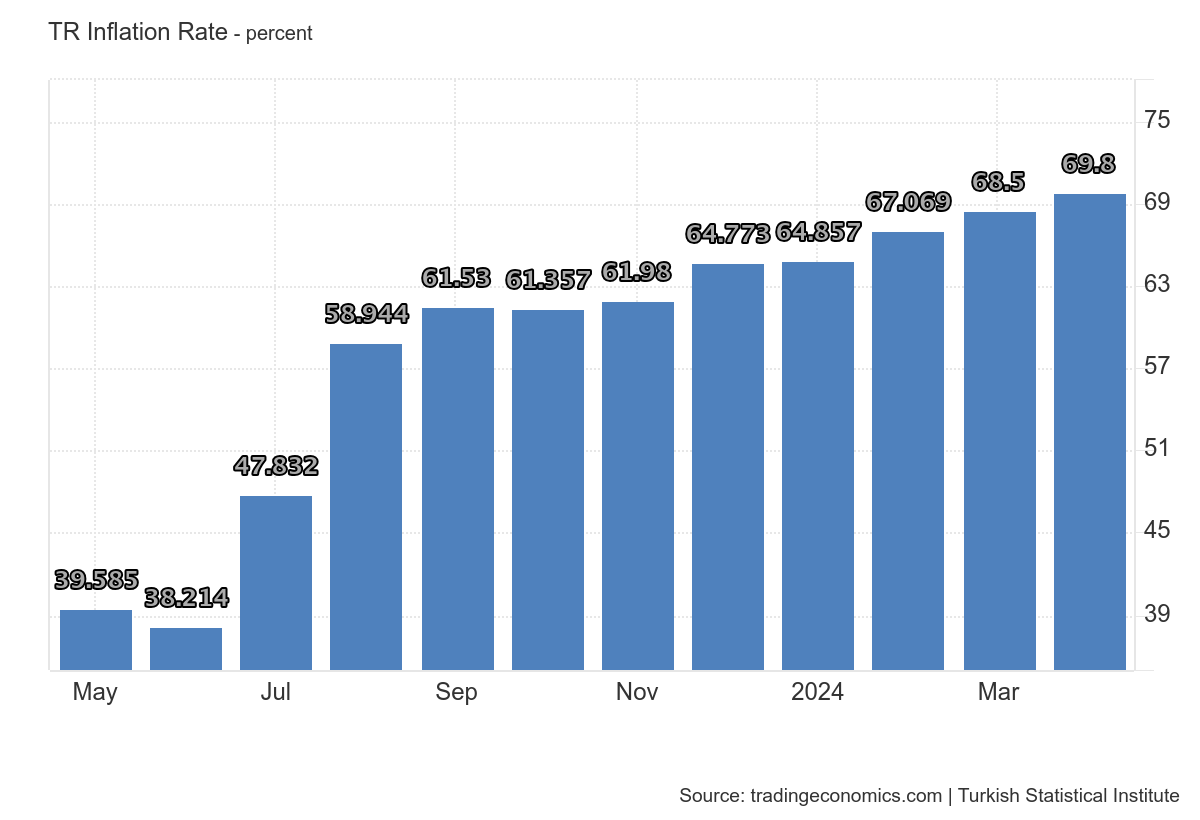

This week, in addition to the U.S. labor data (which we will discuss), Turkey’s inflation data also came out, which was a surprise—perhaps not a good surprise for Turks.

Turkey’s annual inflation rate rose to 69.80 percent in April 2024, up from 68.50 percent the previous month but below market expectations of 70.33 percent.

However, this was the highest reading since November 2022, driven mainly by increases in housing and utility prices (55.55 percent compared to 51.17 percent in March) and transportation (80.39 percent compared to 79.92 percent).

In addition, inflation increased for clothing and footwear (51.20 percent vs. 50.10 percent), alcoholic beverages and tobacco (78.53 percent vs. 62.98 percent), furniture, home equipment and routine maintenance (67.88 percent vs. 63.72 percent) and hotels, cafes and restaurants (95.82 percent vs. 94.97 percent).

On the other hand, food inflation slowed further to 68.50 percent in April from 70.41 percent in the previous period. here is an explanatory chart

Meanwhile, core inflation rose to 75.81 percent from 75.21 percent previously. On a monthly basis, CPI rose 3.18 percent, up slightly from 3.16 percent in March. So it seems to be understood that wages are keeping pace with inflation.

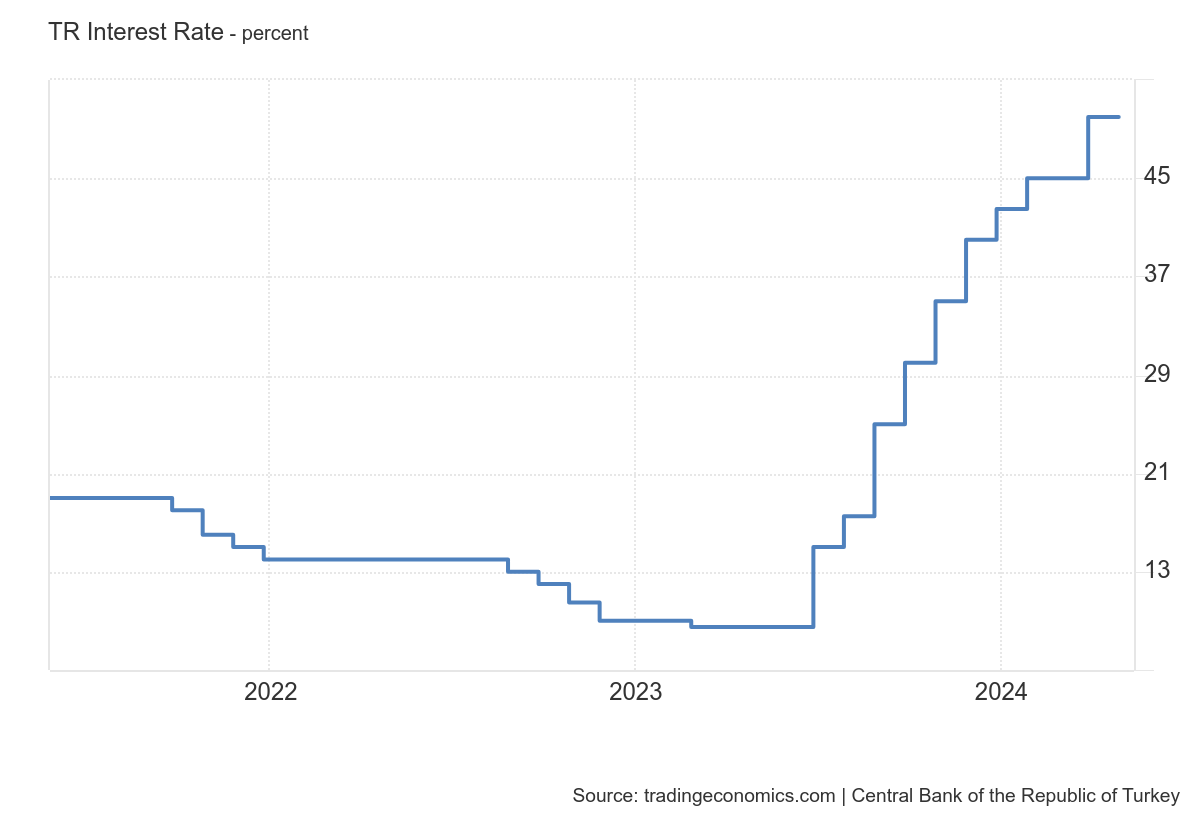

Real interest rates are negative, and not by a small margin

Central Bank interest rates have risen significantly, but they are unable to keep up with Inflation, which is now at 50 percent, as you can see from the following chart

Deposit rates are at 26 percent, so those who deposit money in the bank are losing 42 percent annually. Interbank refinancing rates are also aligned at 43%. With such negative rates, the carry trade—borrowing to invest where interest rates are positive—rages on. Moreover, no one is holding liquidity.

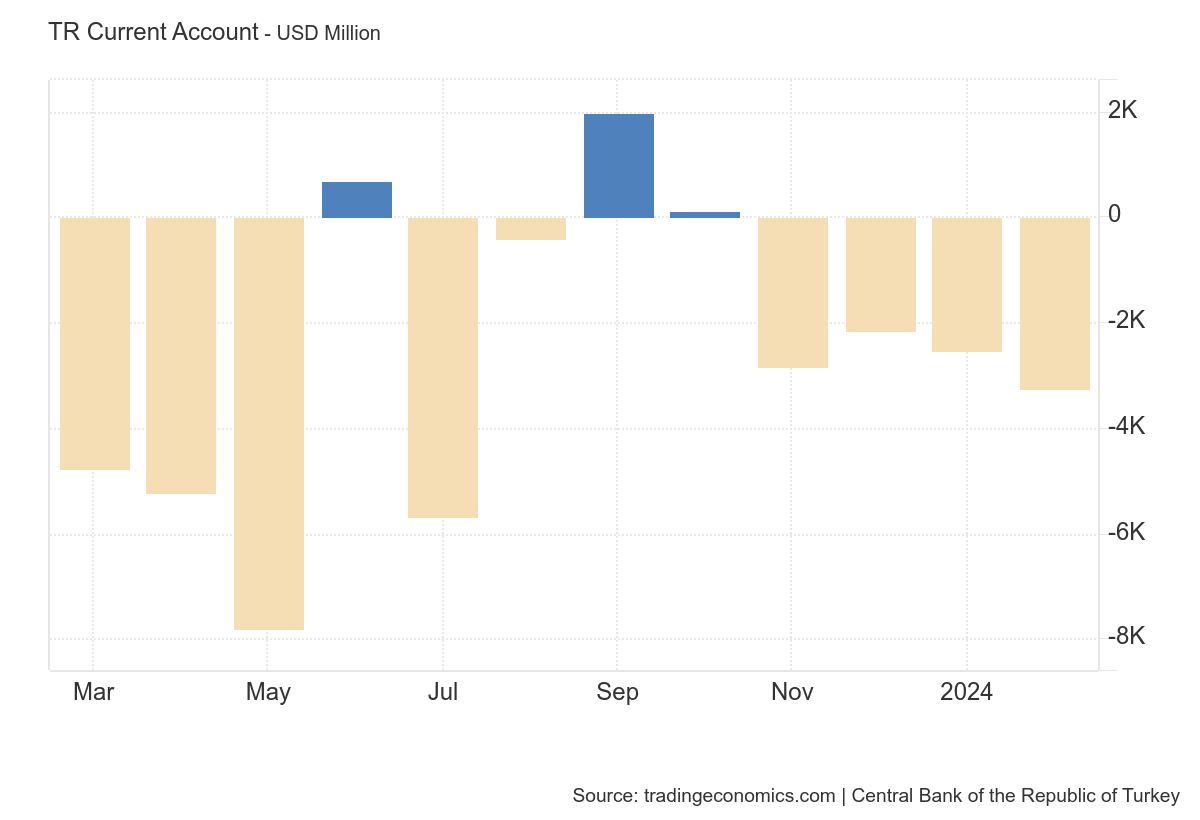

current account is improving; perhaps we are close to balance

There is something positive. Turkey’s current account deficit narrowed sharply to $3.27 billion in February 2024, down from $9.04 billion in the same month a year earlier.

The goods deficit decreased

Excluding gold and energy, the current account surplus widened to $2.11 billion, a significant increase from $0.57 billion in the corresponding period last year. So the deficit is also due to the fact that Turks are trying to invest in gold to escape inflation.

The Turkish lira has not fallen any further

The Turkish lira’s failure to decline further versus the US dollar in response to reports of rising inflation indicates that the current account is stabilizing, and some degree of stability has been attained by the currency.

If the current account consolidation continues, the lira’s exchange rate will stabilize, and finally, inflation should come back under control, albeit at a high level. But the economy is growing by 4 percent year-on-year, and inflation has dropped the public debt on the PIl to 29 percent. In short, inflation has its pros and cons.