Economy and business

US producer inflation increases. It will be another problem for Federal reserve

US: inflation is picking up, also at the production level

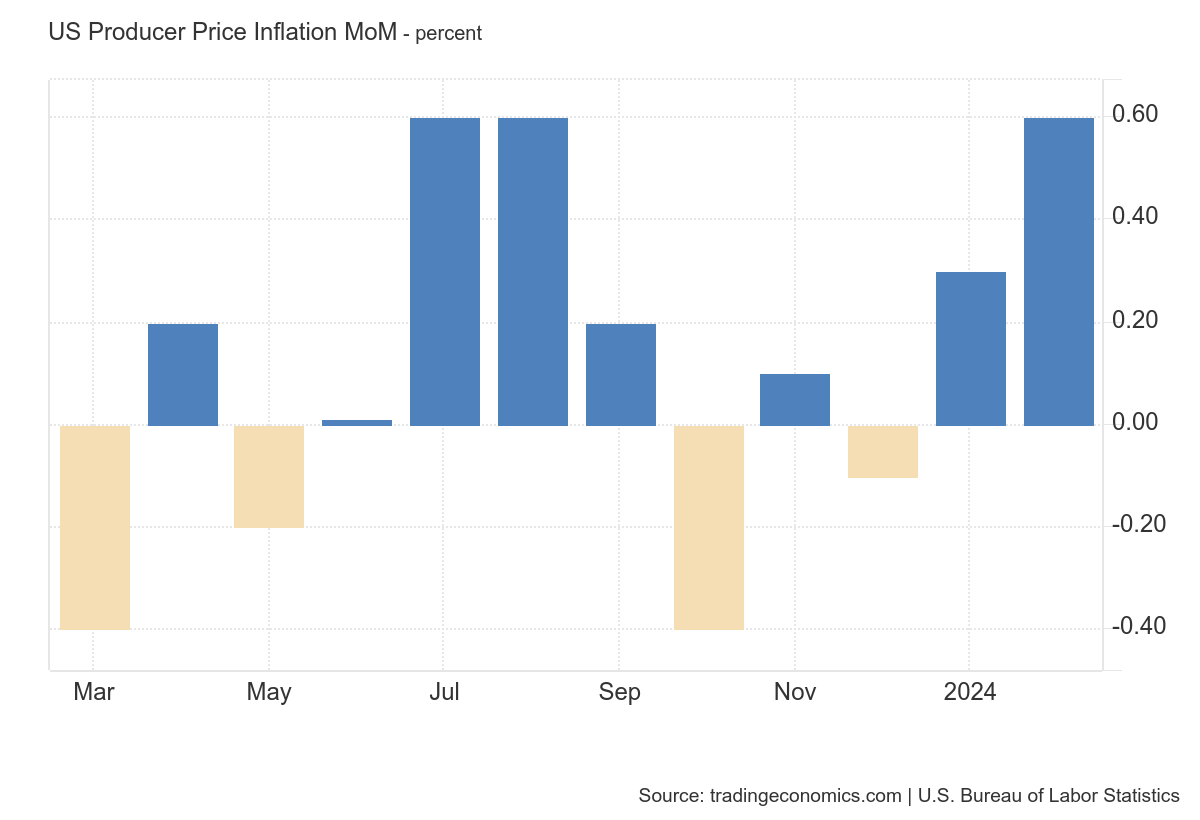

Producer prices added to expectations of accelerating inflation in February, rising 0.6% m/m and 1.6% y/y, which was again above market expectations. Food prices accelerated decently to 1.0% m/m and 0.3% y/y, and energy prices added 4.4% m/m, which reduced disinflationary effects, although the annualized trend is negative at -3.8% y/y. Here is the graph:

Core inflation is not rising as strongly, at 0.3% m/m and 2% y/y. A negative signal is the short-term goods price growth of 0.6% m/m and 2.7% y/y, which reinforces fears of rising commodity inflation.

The peculiarity of the current situation is that consumer inflation has been declining over the last year due to disinflationary effects on goods, against the background of relatively high inflation in services. The upward reversal in the goods sector signals the risks of an acceleration of consumer inflation. Well, it’s another inflation report that comes in above expectations.

The US consumer recovered a bit in February; retail sales rose 0.6% m/m and 5.6% y/y (autos, building materials, and eating establishments were up), although this was worse than expected and January data was revised down to -1.1% m/m. Excluding autos, food, and gasoline, sales rose 0.3% m/m and 2.6% y/y. In real terms, sales added slightly (0.1% mom) but remain more near the lower end of the two-year range. Although demand remains strong, it has started to slowly sag.

Initial jobless claims remain low (209k), with only 1.8m (1.2% of the labor force) still on benefits—no hints of deterioration here.

For now, the reports continue to confirm a shift in inflationary dynamics and the end of the down cycle, adding pressure to debt markets. We will see problems in bond markets very soon