Economy and business

Egypt risks being the real victim between Houthis and Isreal

It is a true barometer of international relations, or, conversely, of simmering armed conflicts. Inaugurated in 1869 by Empress Eugenie after work by the Frenchman Ferdinand de Lesseps, the Suez Canal is a strategic passage between the Red Sea and the Mediterranean and is now used by an average of 50 ships a day (compared with three the year it opened), or 20,000 ships a year. It is all the more crucial as it enables resources to be transported to countries (gas, oil, food, etc.) and thus influences conflict resolution.

While it shortens the Bombay-Genoa distance by 58%, the Suez Canal has above all become Egypt’s third-largest source of foreign currency, after tourism and remittances from emigrants. The Suez Canal, imagined by Napoleon, now carries around 10% of the world’s maritime trade.

Since then, the Houthi rebels, who support Hamas in its confrontation with Israel, have set their sights on the 195-km-long passage in order to destabilize Israel’s allies. In response to this threat, the United States announced on December 19 its intention to create a new multinational maritime protection force, and they called it “prosperity guardian.” EU countries like France and Italy, already with ships in the area, welcome the decision.

With its economy in the doldrums, Egypt is the first country to be affected if maritime trade comes to a halt. In fiscal year 2022-2023, the Suez Canal brought in some 8.6 billion euros for the Egyptian state, a new record.

This represents a “35% increase” on the 6.4 billion euros recorded in the previous fiscal year (July–June), said Suez Canal Authority (SCA) Chairman Osama Rabie. This increase is due to a rise in traffic thanks to a new section dug in 2014 and 2015, which now facilitates the crossing of convoys and reduces ship transit times.

Egyptian President Abdel Fattah al-Sissi, who was re-elected to his third term of office on December 18, plans to widen the canal further to avoid any accidents that could lead to its closure. At present, the limit for ships is set at up to 240,000 tonnes and 66 feet of draught (20.1 meters).

So when the Suez Canal closes, it’s an economic catastrophe for Egypt. In 2021, when the Evergreen ship ran into the canal blocking passage, Egypt lost between $12 and $15 million per day of closure. At the time, insurers estimated a daily loss of billions of dollars for world maritime trade.

Locally, the consequences are immediate, as the canal and its seven subsidiaries employ some 15,000 people and constitute a world apart, with their schools and leisure centers. The windfall for the country is such that each year, Egypt announces an increase in transit fees (+10% to 15% from January 2023).

Egypt’s economy is in crisis

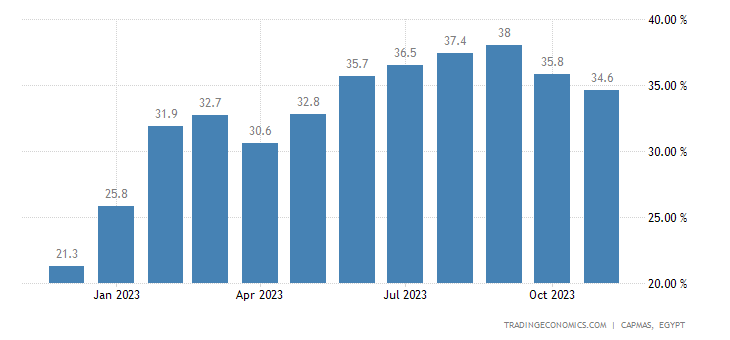

This income for Egypt is all the more vital as the country is drowning in debt. Now inflation is raging over 30% YoY and the last devaluation left families in deep troubles

In August, inflation reached +39.7%, its highest level ever in this country, whose economic crisis continues to worsen as the reforms demanded by its creditors are slow in coming.

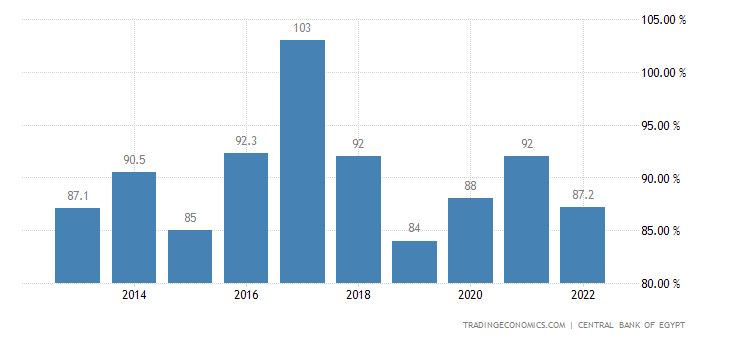

On the other hand, the government is financing pharaonic projects. Between President Abdel Fattah al-Sissi’s mega-projects, subsidies on numerous products, and a monetary policy to support the Egyptian pound, the country’s foreign debt has exploded. It now stands at 90% of GDP. Egypt has not hesitated to draw further financial resources from the canal at a time when the government must negotiate with the International Monetary Fund (IMF).

In December, Cairo secured its fourth IMF loan since 2017, but the $3 billion it will receive over the next four years weighs little, as debt servicing alone for 2022-2023 amounts to $42 billion.

According to Moody’s, the country is one of the five most at risk of defaulting on its foreign debt.

Worse still, 71.5 million Egyptians still depend on the public food subsidy program, which includes not only bread but also rice, sugar, and pasta. In one year, food prices have soared by 71.9%, transport by 15.2%, and clothing by 23.6%.

As a result, 60% of the population lives below or just above the poverty line. The country, with 105 million inhabitants, is the world’s biggest importer of wheat. The war between Russia and Ukraine has already badly hit its supplies. Also, the gaza conflict created problems in the gas supply coming from some fields used in common with Israel.

The soaring value of the dollar in relation to its currency has a direct impact on households since the vast majority of goods are imported into Egypt in dollars.

The Gasa conflict can have an unespected victim: Egypt. And this could be a huge problem for both Europe and the Middle East.