International

France: debt and deficit of the European champion

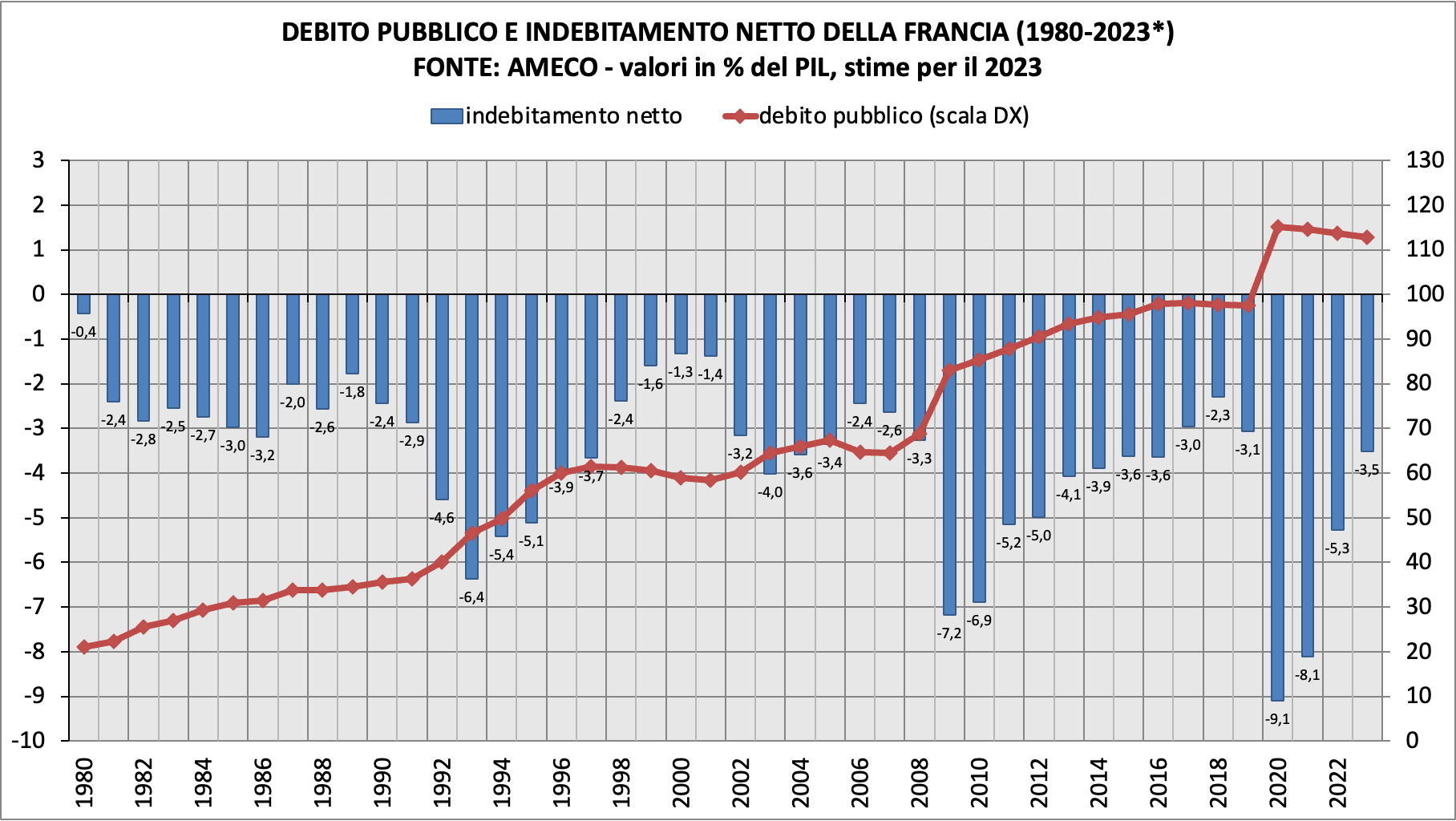

In the EU, if you talk about public debt, budgets, deficits, and the usual, you talk about it in order to antagonise Italy. It is not, however, that the professors who give grades at the European level behave much better; indeed, Germany recently demonstrated how one can falsify the budget and pretend nothing happened for decades. But now let’s talk about France, the second country in the EU. Let us look at an interesting graph provided by Canalesovranista on France

Take, for example, France, which was already close to 100% of its GDP debt ratio before COVID, which exceeded 100% abundantly during COVID and now seems to be on its way to a moderate debt reduction.

The debt, however, continues to increase, but despite this, the debt/GDP ratio has decreased. How was this possible? Simple, with what has been called the absolute evil but which has solved the budgetary problems of so many European countries: inflation.

French inflation over the last three years has been, shall we say, interesting…

The drop between 2021 and 2022 and also in 2022–23 occurred mainly, trivially, because inflation exceeded the debt crediting rate and will do so at current data, even in 2023. Since debt is a nominal value, whereas debt/GDP is a ratio in which the denominator is a real value, which grows with inflation, the debt/GDP ratio is more easily resolved with somewhat higher inflation, such as that from 2021. After all, France in the early 1980s and 1970s was certainly not a country that was light on public spending, yet inflation allowed it to maintain a low debt/GDP ratio.

The ECB’s success in curbing inflation, so to speak, therefore complicates governments’ attempts to contain debt. Incidentally, France has exceeded the European Commission’s sacred deficit/GDP ratio until 2022.

If from 2024 this criterion is reintroduced, will France be able to meet it, or will it join the group of countries that now consider this value unrealistic?