International

Germany’s China Dilemma: Stay for Profits, Go for Stability

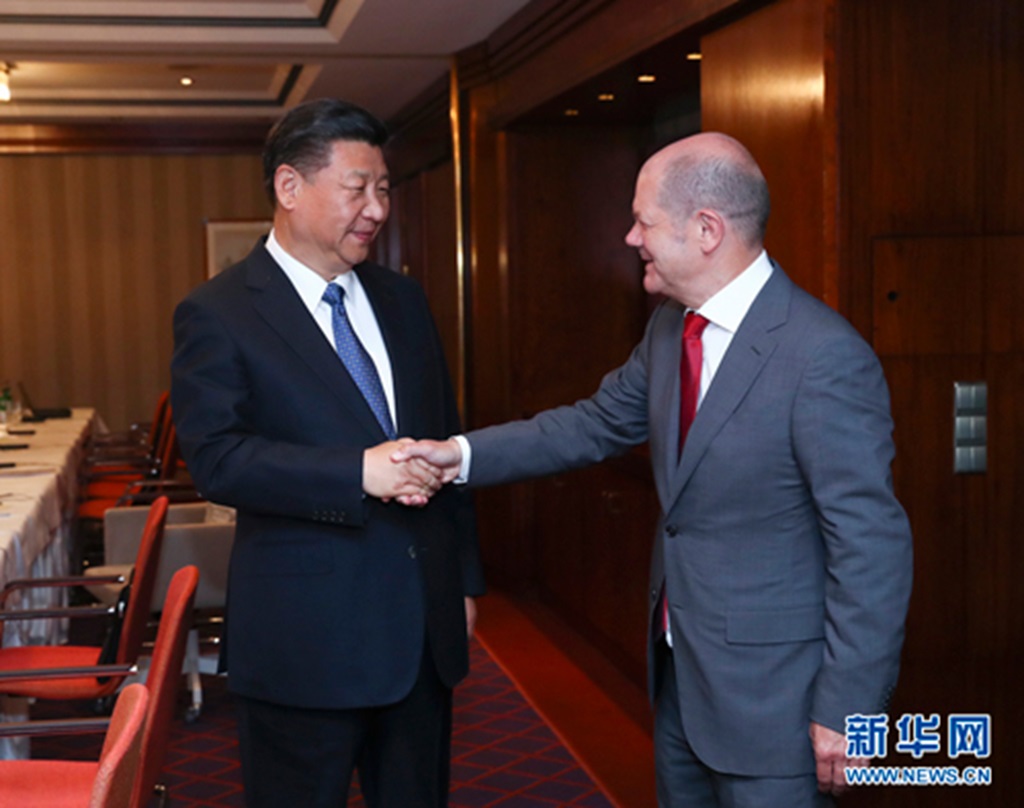

Should I stay or should I go? This is the sentiment of many German companies as Cancellor Scholz prepares to land in China with a retinue of business leaders to discuss the future of German-Chinese relations. In a complex situation in which Berlin advises against accelerating dependence on Chinese supplies, on the other side he arrives with a load of hope.

In July, when it published its national strategy on China, Olaf Scholz’s government called on economic actors to embark on a crisis path: reduce the level of dependence on Beijing to mitigate risks (de-risking), but without breaking with a market of 1.4 billion consumers.

Almost a year on, and with Olaf Scholz in China until Tuesday, German companies’ approach to this issue is far from uniform.

There is a perceived inflection

First observation. An inflection is perceived on imports. According to an Ifo Institute survey of 4,000 German companies, the percentage of manufacturers integrating large quantities of Chinese intermediate goods (electrical and electronic components, chemicals, etc.) has dropped from 46 percent to 33 percent over two years. The same trend holds true for wholesale and retail trade.

–

Germany: a crisis with China would be as bad as Covid

Strongly export-oriented companies have been the most active, motivated by geopolitical uncertainties and fears of war with Taiwan. On the other hand, the process seems to have reached a plateau and imports have not decreased when intermediate goods are produced by local subsidiaries.

Record levels of investment

Second observation. Many players are choosing to hold out and reinvest. Large companies, in particular, are moving ahead with their already planned and ongoing investments. BASF is building a 10 billion euro manufacturing site in Zhanjiang, southern China, and Volkswagen has just announced a 2.5 billion euro investment to strengthen its R&D in Hefei, China’s “Silicon Valley.”

“We see no signs of de-risking by German companies. Their investment levels in China have stabilized at record levels,” analyzes Max Zenglein, Chief Economist at the Mercator Institute for China Studies. While foreign direct investment fell sharply last year, German direct investment increased by 4.3 percent to 11.9 billion euros, according to the Bundesbank.

Rolling out the red carpet

In China, the red carpet is always rolled out for big companies. Their investments are part of Xi Jinping’s plan to reduce risks to the country’s economy in the event of a crisis with the West.

German companies, on the other hand, have few illusions about how the situation will develop. According to a survey by the German Chamber of Commerce in Shanghai, more than 70 percent of them expect to lose market share and profits.

The truth is trivial: “We are no longer competitive.” Volkswagen wants to cut its workforce by 20 percent. “While U.S. industry suffered a ‘China shock’ in the decade following Beijing’s entry into the WTO, with an estimated loss of 560,000 jobs, German industry was booming thanks to China,” point out Noah Barkin and Gregor Sebastian in a recent Rhodium study.

In reality, the U.S. is keeping its economic system on its feet by running up debt and contributing to industries. In part, that is also what China is doing. However, Germany is Germany, the EU is the EU, and all are based on infighting. It’s too bad that, by dint of the struggle, European companies are bleeding out.

Then there is the fact that Europe does not have, by dint of austerity and savings, even a truly large internal market. China, with 1.2 billion people and a growing middle class, has an internal market. Europe, a country of decadent old men, does not.

On the other side of the Rhine, this pill will be hard to swallow. And the “Chinese pact” struck years ago between German politicians, companies, and unions may begin to crack.