International

Iron Africa: a new great iron mine could change the global supply

The state of Guinea in West Africa recently approved a joint development agreement between the government, Rio Tinto/Simfer, and the Simandou Winning Consortium (WCS) to develop the Simandou iron ore mining project. This is a huge project with a total cost of $20 billion and has the potential to heavily affect the world’s iron supply.

The National Transitional Council (NTC), Guinea’s legislative body under the interim regime, announced the approval of the agreement on Feb. 3. “In short, this agreement provides for… the construction of rail and port infrastructure by December 31, 2025, and the start of iron ore production in the first quarter of 2026,” the NTC said in a statement. Recall that Guinea is under an interim government and, at least in theory, is expected to hold democratic elections soon.

Simandou has 2.4 billion metric tons of estimated reserves, from which it can produce 2.25 billion metric tons of 65 percent pure iron. Under the agreement, WSC will develop blocks 1 and 2, while Rio Tinto and Simfer will develop the remaining two blocks. Together, this represents over 1.46 million square kilometers of iron mining potential.

The Rio Tinto/SSimfer consortium includes the multinational metals and mining company, which holds 53 percent of the two blocks. Meanwhile, the Simfer joint venture between Chalco Iron Ore Holdings and the Government of Guinea holds the remaining percentage in Blocks 1 and 2. Finally, Singapore-based conglomerate Winning International Consortium, China-based Weiqiao Aluminium, and London-based United Mining Suppliers are part of WSC. A group of large companies for a large complex.

An untapped resource hub for iron ore mining.

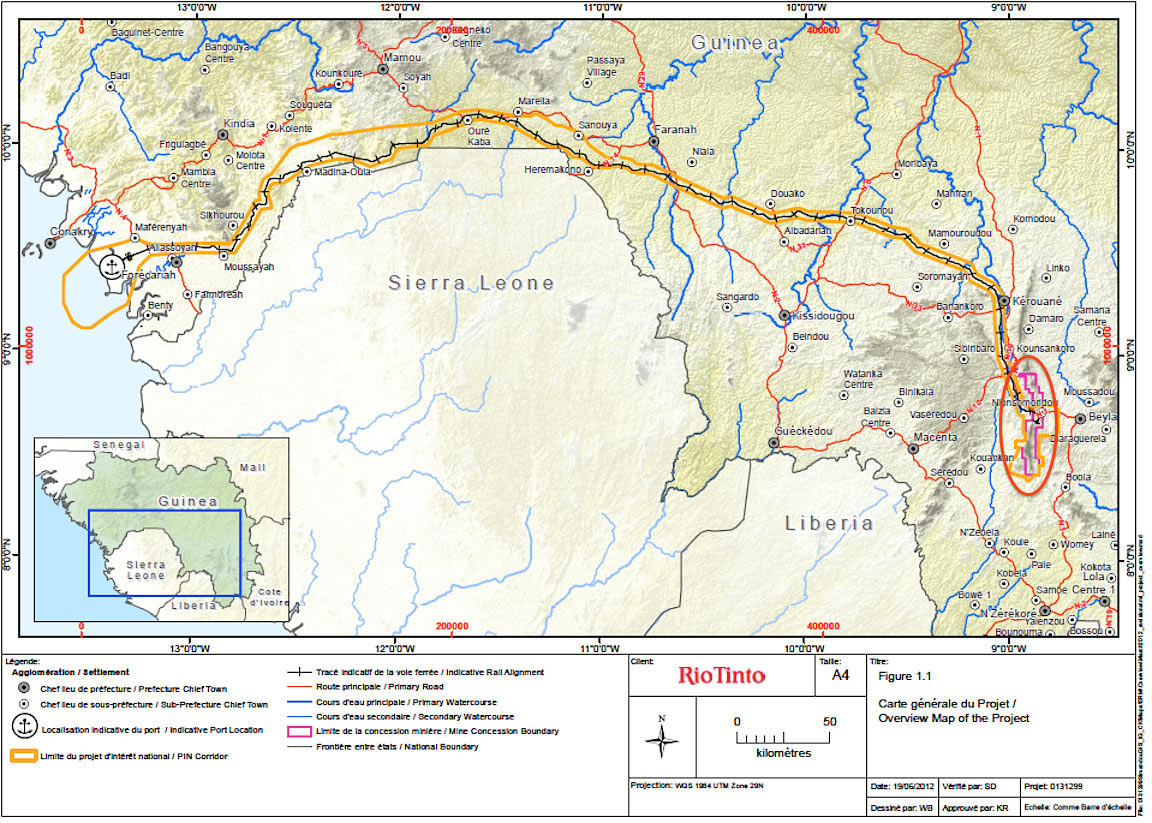

Simandou is located in the Nzérékoré Region of southern Guinea, about 900 kilometers from the capital and port city of Conakry. The council also mentioned the potential construction of a steel mill with an annual capacity of 500,000 metric tons, although it did not indicate whether it would be raw steel or cast and rolled products.

NTC added that work is also underway to build a 670-kilometer double-track line to Forécariah Prefecture on the Atlantic coast and a deep-water port at that site. Currently, it appears that Chinese steel producers will be the likely end users of Simandou iron ore.

A project that could change the world market

In January, Rio Tinto said it plans to begin infrastructure work on the huge Simandou iron ore project this year, after nearly three decades of setbacks and scandals.

Set to be the world’s largest and highest-grade new iron ore mine, the project will add about 5 percent to the global seaborne supply when it goes into operation. From this perspective, partnerships with such a large number of global mining and marketing companies are almost necessary, given the enormity of the project and the amount of production that will result.

The project has been the subject of prolonged negotiations due to its complex ownership structure, delays caused by legal disputes, political changes in Guinea, and construction challenges. Rio Tinto alone plans to invest $6.2 billion.