International

Is the EV-car industry heading toward a bloodbath?

As the FT reports, Carlos Tavares, head of Stellantis, warned that automakers who cut prices on electric vehicles too fast risk a “bloodbath” in the industry, just hours after Ford said it would cut production of its F-150 Lightning electric pickup because, trivially, there are no sales.

Ford said Friday that it plans to align production of the vehicle with customer demand, predicting “continued growth in global electric vehicle sales through 2024, albeit lower than expected.” For a capitalist company to align production and sales, it should be non-news: you produce because you sell. In a world that thrives on communication and wishful thinking, however, it is news. Yet the gasoline-powered F-150 has been the best-selling vehicle in the United States for years, and the launch of the Lightning model in 2022 has been seen as an important moment in the evolution of electric vehicles.

Ford has scaled back plans for an EV battery plant, while General Motors and Tesla have put some of their electric vehicle expansion efforts on hold.

Rental group Hertz, which added Teslas to its fleet in 2021, has begun selling 20,000 EVs, or one-third of its global electric fleet, to buy more gasoline-powered vehicles amid strong demand for internal combustion cars.

Tavares, whose company owns the Jeep and Ram brands that compete directly with Ford and GM, said the slowdown in demand for EVs globally is due to high prices, but warned companies against cutting them on vehicles where profit is already minimized. “If you cut prices without taking into account the reality of costs, it’s a race to the bottom that will end in a bloodbath,” he said. “That’s exactly what I’m trying to avoid.”

Stellantis is one of the largest sellers of electric vehicles in Europe through its Peugeot, Fiat, Opel, and Citroën brands, and as of this year, it is embarking on an electric vehicle “offensive” in the United States.

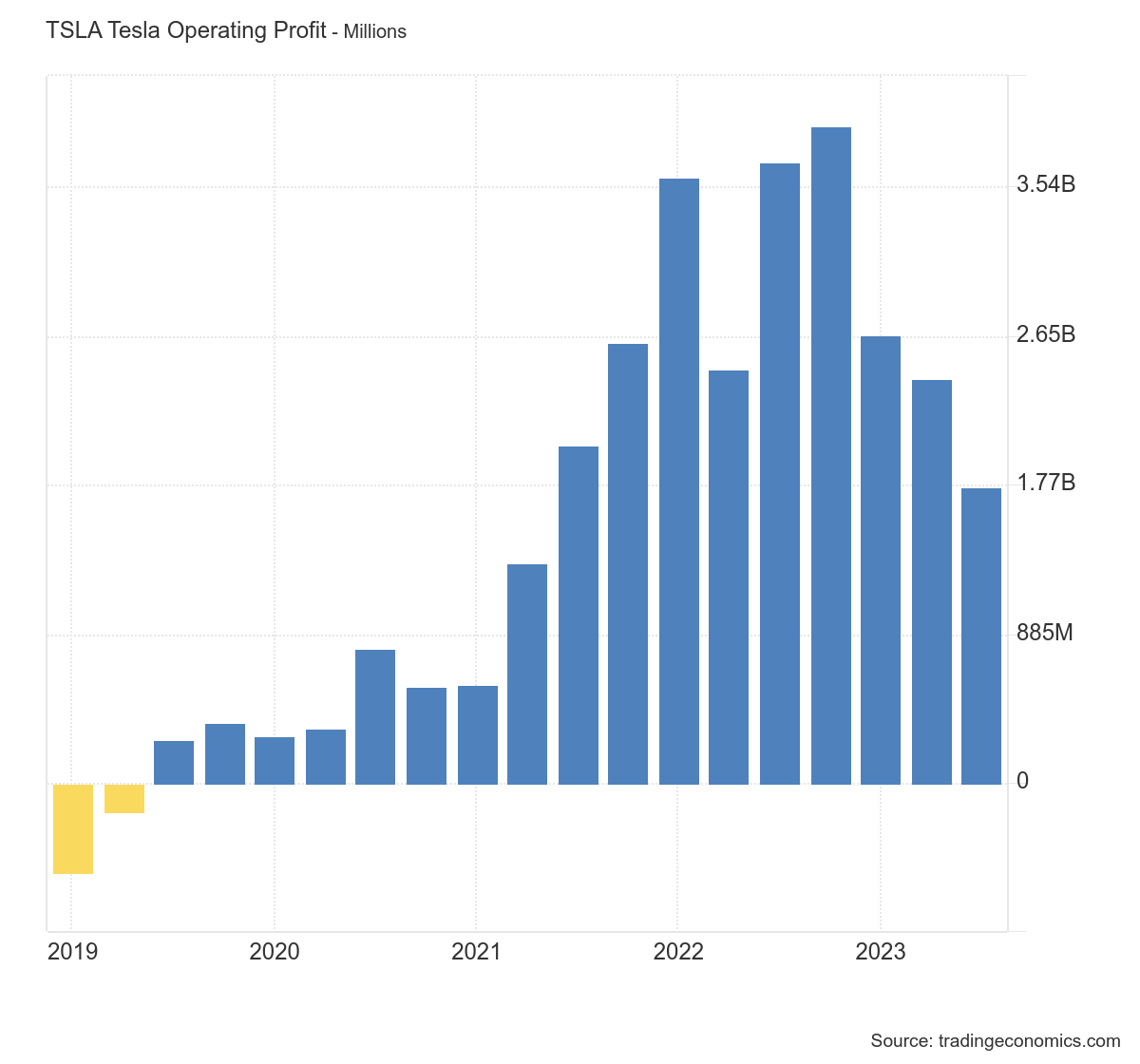

Tavares cited Tesla, which has cut prices several times in the past year to stimulate demand, sparking a price war with Ford, but at the same time has seen a decline in operating profits, as can be seen in the chart below:

EV cars are not yet the future

The market share of electric vehicle sales in the UK and Europe declined last year, while growth in the US slowed.

According to data from Kelley Blue Book, a research firm owned by Cox Automotive Group, 1.2 million electric vehicles will be sold in the United States by 2023, including 317,168 in the fourth quarter. Last year, electric vehicles accounted for 7.6 percent of the domestic automotive market, up from 5.9 percent in 2022.

However, “although records have been set, the oft-reported slowdown is real,” Kelley Blue Book analysts said. “The electric vehicle market in the United States is still growing, but not as fast.”

Sales in the last three months of 2023 were up 40 percent from the same period a year earlier, moderating from 52 percent in the fourth quarter of 2022.

What does EV mobility lack in the future?

- an adequate cost, allowing it to enter the small car sector as well.

- an adequate charging network;

- reliability that does not put the car at the mercy of the weather, as is happening right now.

The first two factors are essential: a basic electric F 150 Lightning costs $50,000; a basic internal combustion model costs $36,000. The cost difference is still excessive. Then there is the problem of charging: battery charging points are not only inadequate but often out of service. Data states that 20.8 percent of charging points in the U.S. are out of service, for one reason or another, and let’s not consider cross-compatibility issues. In the end, it is as if one out of every five gas pumps is out of service.

Companies that have rushed to invest in such immature technology so far in advance now risk big economic problems: if they produce EV cars, the market does not want them at these prices, and cutting prices means generating losses. If they don’t produce them, their investments are unproductive. Either way, it is an economic loss.