International

Russia: balance of payments sees major capital flight

The Central Bank has discovered a record hole in the Russian economy’s currency balance that is a record for the past 11 years.

Elvira Nabiullina has seen this balance of payments hole grow during her tenure, but this time the result is remarkable: in the January-December period, $9.9 billion flowed out of Russia for transactions that did not fall into any of the standard categories of payments (imports, purchases of foreign assets, debt repayments, etc.) and thus were contradictory to a current account balance that nevertheless remained positive.

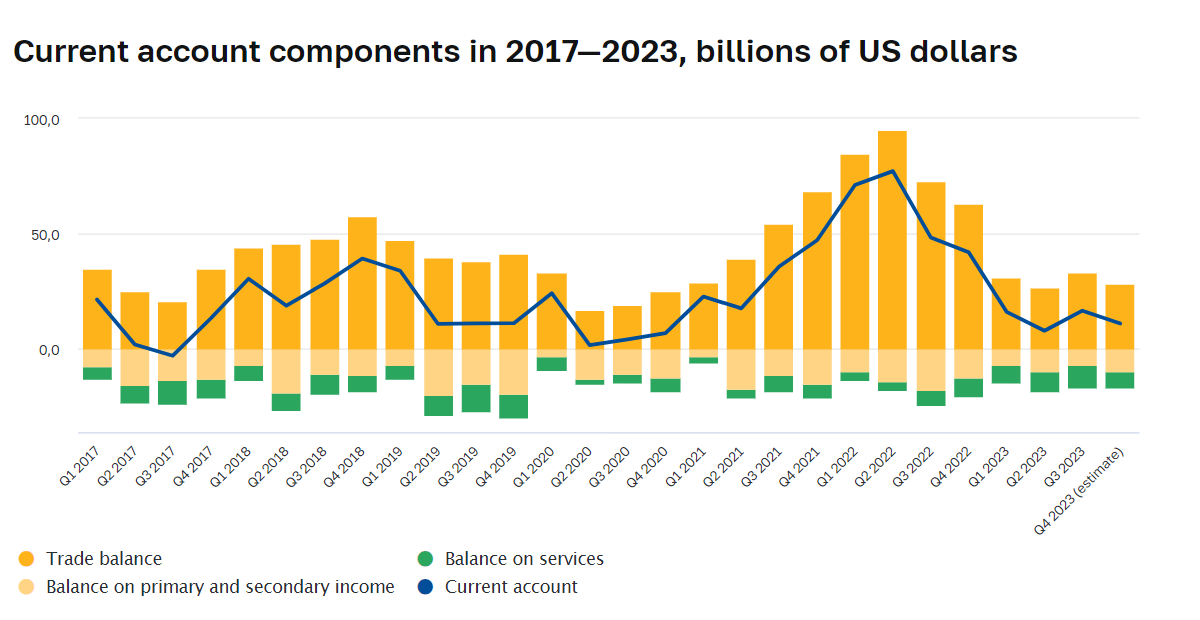

The current components of the balance of payments, which should usually explain almost all the movement in the balance of payments, are positive, even though their balance is declining

This item, which, as the Central Bank itself explains, represents “statistical discrepancies” and may also reflect shadow capital outflows, has increased by 70 percent since 2022. These are transactions that do not result from corresponding real transactions, that is, money that is literally being taken away.

One out of every five dollars of the balance of payments surplus—the fictitious foreign exchange earnings of the economy, which the Central Bank estimated at $50.2 billion for the current year—turned out to be a sham or disappeared under unspecified circumstances, the statistics show.

The volume of such “errors and omissions” has become almost a record in Russia’s modern history. More have “disappeared,” only in the “fat years” of oil more expensive than $100 a barrel ($10.3 billion in 2012), as well as in the first years after the collapse of the USSR, when the economy was losing currency like a sieve ($10.3 billion in 1995).

The peak of the 2023 “shadow outflow” occurred in the second and third quarters (nearly $7 billion), when the ruble slipped rapidly downward and crossed the $100 threshold. At that point, in order to extinguish the currency devaluation, the Central Bank introduced a requirement to sell foreign exchange proceeds, and the government obliged large enterprises to report foreign exchange reserves accumulated abroad, which then paved the way for the “Council” to exchange foreign currency into rubles, strengthening the exchange rate.

This phase of “warlike currency control,” formally in effect until the end of April, is likely to be extended indefinitely, sources familiar with the situation told Bloomberg. It is nothing unusual when a country is involved in war events.

The controls, however, are likely to be insufficient to control financial outflows, especially when they are operated by private individuals.