International

VW tries to develop a new state-of-the-art battery for its EV cars

VW tries to develop a new state-of-the-art battery for its EV cars

After many delays, Volkswagen is turning to its development partner Quantum Scape to develop new solid-state batteries, trying to regain momentum in the autoEV market.

The group is in talks with French company Blue Solutions, which already produces solid-state batteries for Daimler Truck electric buses. A development agreement is planned for passenger cars; VW did not comment on possible discussions with Blue Solutions. With Quantum Scape, the group is on track with its project.

The much-acclaimed super-batteries are a key element in tomorrow’s electric drive and, according to some experts, the holy grail of battery research. They are considered safer in terms of fire protection and allow a longer range with shorter charging times than conventional lithium-ion batteries. But Volkswagen’s search for new collaborations highlights a number of technical hurdles facing manufacturers on the road to mass production.

According to a spokesman, Blue Solutions, which belongs to the French conglomerate Bolloré, is working on a car battery. It has development agreements with BMW and another company. Blue Solutions is in talks with a third company. A Gigafactory is expected to be built by 2029.

Toyota, in particular, has said it might be on the cusp of such a breakthrough. Other automakers are also working with various battery companies on versions of this new technology.

Development drags on

The automotive industry has high hopes for promising solid-state batteries. For example, through its collaboration with Quantum Scape, Volkswagen has promised an e-Golf with a range of 750 kilometers by 2025. But despite decades of research and billions of dollars of investment, new battery development remains a complicated undertaking. Investment bank Goldman Sachs expects commercial production of QuantumScape batteries only in the second half of the decade.

Investor interest in the technology has therefore waned, says Jeff Peters of Ibex Investors. According to Pitchbook data, global venture capital investment in research-based companies fell to $146 million in 2023, after rising to more than half a billion dollars in the previous five years.

“Many promises have not been fulfilled, and several automakers and investors have had their fingers burned,” says Rory McNulty of the consulting firm Benchmark Mineral Intelligence. There are many well-documented data and technologies, but it remains an open question whether the industry will be able to implement them reliably and at scale.

Faster charging but less durability?

In addition to durability, a critical issue is recharge time, which for current Blue Solutions batteries is about four hours. This is less of an issue for trucks or buses that can be recharged overnight in the depot than for cars that need to be recharged on the go.

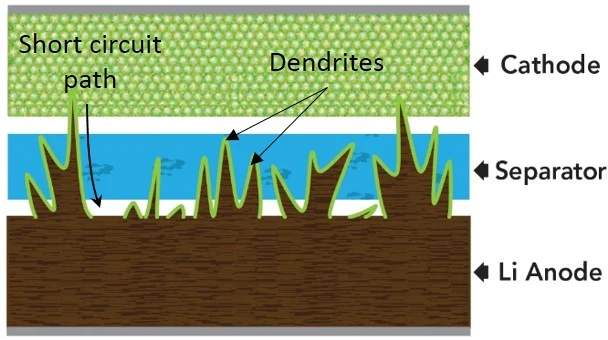

The company is therefore working on a corresponding battery with a charging time of 20 minutes. The use of lithium metal can greatly increase performance, but it triggers reactions that can lead to cracks and short circuits in the battery. The problem is well known and is called dentrite development—root-like intrusions of lithium into the solid-state electrolyte. If these roots reach the other electrical pole, they short-circuit the battery. This is a serious problem, but one that many researchers are solving with different solutions.

Last year, Japanese automaker Toyota announced a technological breakthrough that would enable mass production starting in 2027/28. A flagship model with a range of 1,000 kilometers is planned. Once fully charged, the solid-state battery would cover 1,200 kilometers at once, which should take only ten minutes. However, the current schedule is already two years behind the original target.