International

Warnings of a Looming Crisis in the US Real Estate Sector

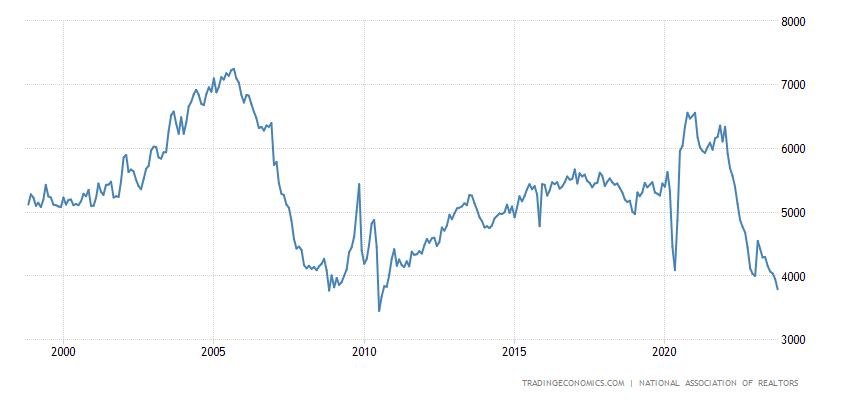

The US real estate sector is facing dire circumstances, prompting concerns about potential countermeasures by the central bank. Recently released data on non-new home sales reveals a worrisome picture, with a 4.1% month-on-month decline, reaching a seasonally adjusted annualized rate of 3.79 million units in October 2023. This represents the lowest level since August 2010, falling below the forecasted 3.9 million.

Persistent issues, such as a shortage of housing inventory and the highest mortgage rates in a generation, continue to exert pressure on the housing market. Despite ongoing challenges, Chief Economist Lawrence Yun of the National Association of Realtors (NAR) notes that multiple offers are still happening, especially for prime and mid-priced homes. However, price concessions are becoming more prevalent in the upper-end market.

As of the end of October, the total housing inventory stood at 1.15 million units, showing a 1.8% increase from September but a 5.7% decrease from the previous year. Meanwhile, the average price of existing homes for all housing types in October reached $391,800, reflecting a 3.4% increase from October 2022.

Sales declined in the Northeast, South, and West, while remaining unchanged in the Midwest, indicating a market where prices are rising but sales are falling, pointing towards a frozen market. Here is the chart from Tradineconomics:

The situation is reaching a critical level of sales, lower even than during the Covid-19 period. Notably, prices have not dropped as much as anticipated, leading to speculation that this is a ‘work in progress’ phase. The concern is that leaving owners without sales for a few months may trigger further developments.

Adding to the ominous outlook, renowned American economist Gary Shilling, who accurately predicted the subprime mortgage crisis of 2008, is warning of another crisis on the horizon, specifically in the commercial real estate (CRE) sector.

Shilling, speaking on the investment podcast ‘The Julia La Roche Show,’ identifies commercial real estate as the current ‘biggest bubble.’ While he acknowledges that it might not reach the scale of the subprime mortgage crisis, he contends that it’s a bubble showing signs of bursting.

According to Shilling, office vacancies are a clear indicator of the challenges faced by the commercial real estate market. Vacancy rates are nearly 1.5 times the amount at the end of 2019, potentially resulting in up to 90 million square feet of unused office space in the US, according to a report by real estate firm Cushman & Wakefield. Moody’s Analytics considers this quarter’s vacancy rate of 19.2% ‘perilously close’ to the record rate of 19.3% in 1986 and 1991.

The struggling commercial real estate market is attributed to higher interest rates, making real estate less attractive compared to risk-free government bonds and leading to a significant decline in asset values, particularly in the office segment.

The convergence of poor sales, overvalued prices, and a significant commercial real estate bubble suggests an impending crisis. The key questions now revolve around when it will happen and the potential magnitude of the impact. The real estate market is undoubtedly at a critical crossroads, and stakeholders are closely watching for any signs of the bubble bursting.