Italy

Italian manufacturing indicates expansion. How come?

The Italian manufacturing forecast indicator marks an unexpected positive figure, which is consistent with an expansion profile.

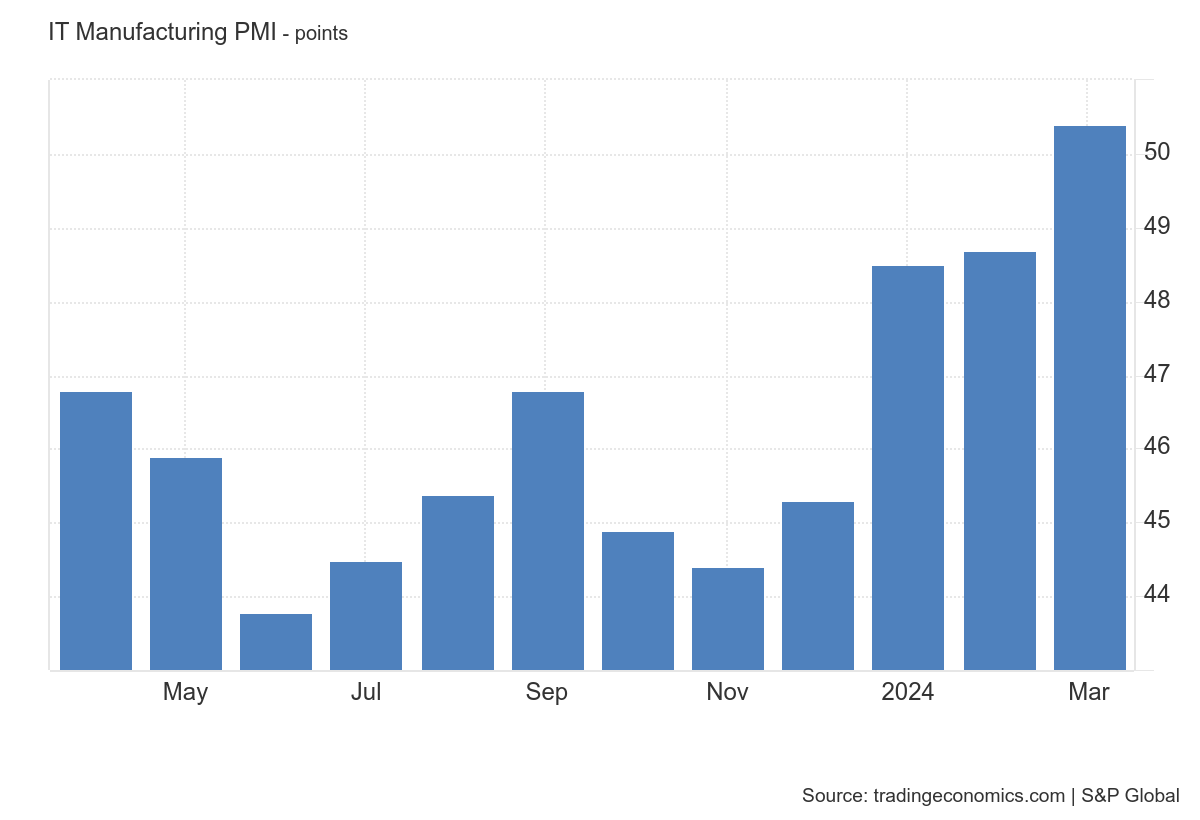

Italy’s HCOB manufacturing PMI rose to 50.4 in March 2024 from 48.7 in the previous month, better than the market forecast of 48.8. The latest reading indicates the first month of expansion in the country’s industrial sector after 11 months of contraction.

Both new orders and production recorded new growth, albeit marginal. Meanwhile, companies expanded their workforce for the second consecutive month, with the job growth rate solid and the fastest in a year.

Purchasing activity recorded the smallest decline in a year, so it can be assumed that firms are rebuilding inventories in anticipation of increased production activity.

In terms of price trends, the decline in input prices was only marginal and the least pronounced in just over a year. As a result, companies have once again passed on reduced costs to customers, resulting in the largest discounts on selling prices in the past four months.

Looking ahead, optimism toward the outlook for the coming year reached a seven-month high and exceeded the historical average, amid optimistic growth forecasts and hopes for stabilizing market conditions.

Here is the related graph

Why the optimism? We can, in general, see three causes:

- Lower production costs. Producer prices are at the 123.3 level versus Germany’s 127.6. Not only that, expectations in the short term are for a further decline. That makes Italy competitive with Germany, which is not only a customer but also a competitor of Italy.

- Again, compared to Germany, Italy has a system less entangled with green regulations.

- Evidently, the greater openness to the Mediterranean, Africa, and the Americas compared to Germany, which was more focused on China and India, is benefiting Europe.

However, there is not much to celebrate. The positive value may just be an episode in a longer-term contractionary outlook.