Economy and business

Italy and Euro Area: Inflation is no more a problem, growth is

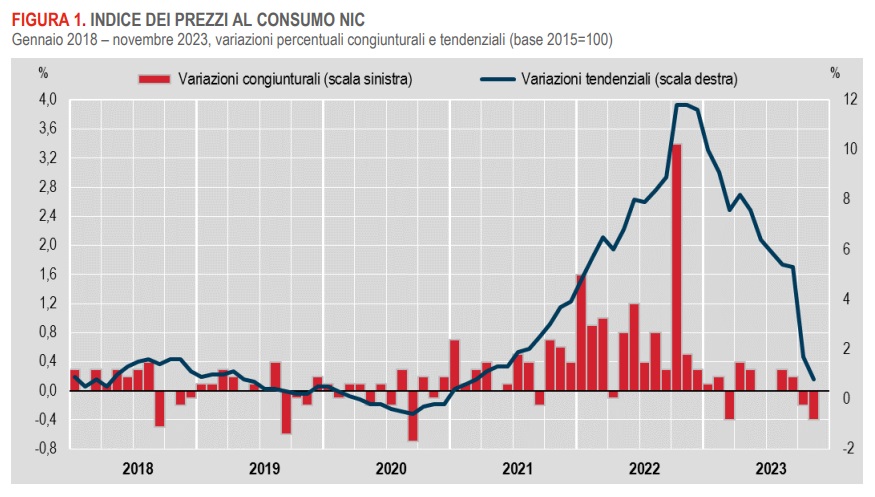

The forecast INPS data on CPI and Core inflation in Italy are out and they are falling sharply. Let’s see what Istat, Italian statistical authority, tells us. According to preliminary estimates, in November 2023 the national consumer price index for the entire community (NIC), including tobacco, recorded a decrease of 0.4% on a monthly basis and an increase of 0.8 % on an annual basis, from +1.7% in the previous month. So we are at -0.4% MoM and +0.8 YoY.

The deceleration in the inflation rate is mainly due to energy prices, both unregulated (from -17.7% to -22.5%) and regulated (from -31.7% to -36.0%), and, to a lesser extent, to the slowdown in processed foods (from +7.3% to +6.3%), in recreational, cultural and personal care services (from +5.5% to +4.6%) and of transport-related services (from +4.0% to +3.5%). These effects are only partially offset by the acceleration in prices of unprocessed food (from +4.9% to +5.8%).

“Underlying inflation”, net of energy and fresh food, also continues to slow down (from +4.2% to +3.6%), as does that net of energy goods alone (from +4 .2%, recorded in October, at +3.7%). This means that wage dynamics are also calming down, and this is not a good sign.

After canceling out in October, the trend trend in the prices of goods fell to negative values (to -1.3%), while that of services remained at positive values, although slowing down further (from +4.1% to +3, 7%). The decline in the benid sector should be quite indicative of the less than positive trend for manufacturing.

Here is the graph:

Variation in Trend (long term) and conjuncture (short term- bar graph)

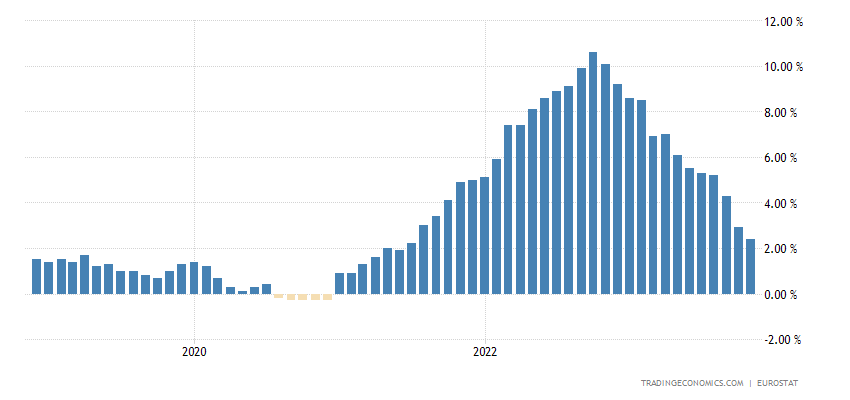

All this also has repercussions at a European level, with inflation in the Euro area falling, as a whole, to 2.4% according to the forecast estimate, on an annual basis, reaching the lowest level since July 2021 and falling below below the market consensus of 2.7%.

Meanwhile, the core rate, which excludes food and energy price volatility, also fell to 3.6%, marking its lowest point since April 2022 and lower than forecasts of 3.9%. The cost of energy collapsed by 11.5% (compared to -11.2% in October) and inflation rates decreased for services (4.0% compared to 4.6%), food, alcohol and tobacco (6.9% compared to 7.4%) and non-energy. industrial goods (2.9% versus 3.5%). On a monthly basis, consumer prices fell 0.5% in November, the largest monthly decline since January 2020. Here is the related chart

Therefore, for the Euro Zone, but above all for Italy, the problem is ceasing to be inflation and is once again becoming growth. Such a strong drop in inflation means a strong, very strong economic slowdown, especially for our country. Now inflation is no longer a problem, as, frankly, it wasn’t even before, given that the cause was external, linked to the energy shock and not internal, due to excess spending or demand.

At this point we need to weigh growth and it would be time to do so with an expansionary fiscal policy and with important investments, not with the usual monetary policy which does nothing but create bubble after bubble, but the load of bureaucratic rules and constraints of budget is such as to make this path, under current conditions, unrealistic.