Italy

Unicredit is no more a Global Systemic Bank. but the important it is solid and profitable

The credit sector is currently experiencing major upheavals, linked to a rapidly changing economy that sees a change in the positions of individual countries and institutions globally. Banks that were once queens of the market are becoming more peripheral and irrelevant in the global system, and, unfortunately, many of these changes are affecting Europe.

The historic Italian bank UniCredit, which now has a strong presence in Germany and Austria, has been removed from the list of global systemically important banks by the Financial Stability Board (FSB), the G20’s financial governance body, which focuses primarily on the ability of institutions to absorb losses, emphasising the need to hold an additional capital buffer and to subject themselves to stricter scrutiny of their operations. The news was reported by Forbes Italia.

UniCredit – which, moreover, was the only Italian present, is not, however, the only one to have been removed from the list. Credit Suisse too, obviously as a result of its bankruptcy and takeover by Ubs, has been removed, albeit for much more serious and well-founded reasons. Instead, China’s Bank of Communications was included for the first time. Changes that in fact brought the list stipulated by the Financial Stability Board down from 30 to 29.

In fact, in recent years, after a complex period also linked to the various financial events in Italy and Austria, Unicredit experienced a fairly positive period in its stock market listings.

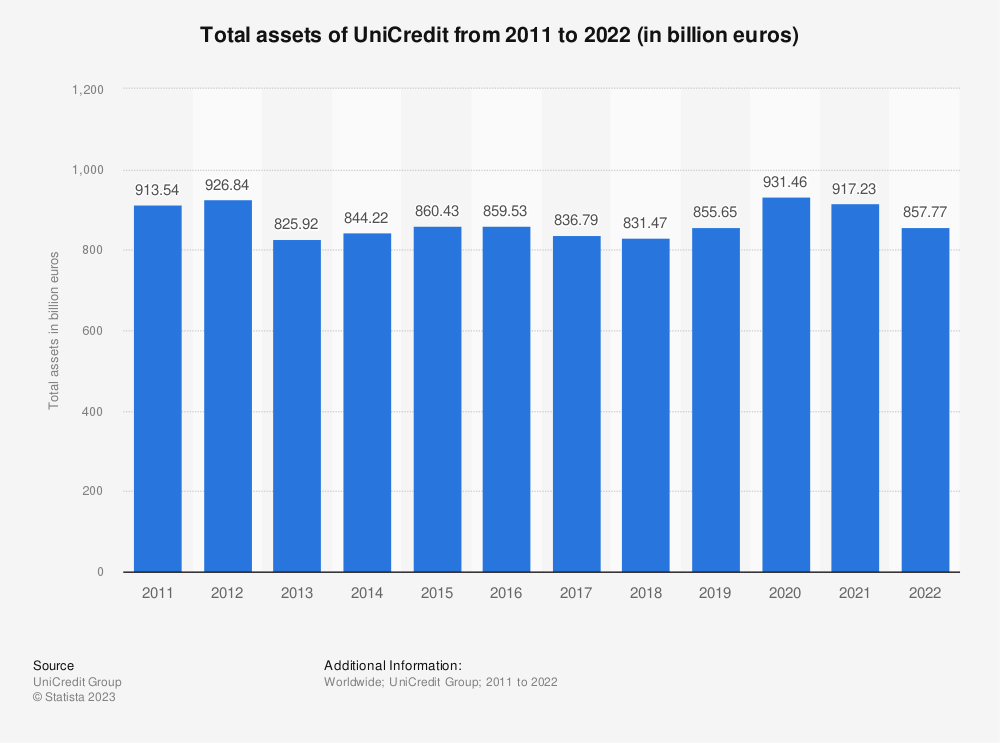

In fact, the group’s assets were certainly not reported as growing in recent years, showing how credit granted was, in fact, declining. It was no more growing in direct or indirect loans, but this is also due to the stagnating economics of Europe.

This exit signals the increasing marginality of Italian banks in the international financial system, which in itself is not a bad thing, if it is accompanied by a strengthening of their assets and, above all, their greater role in stimulating the national economy. If anything, it is precisely this point that is lacking.

Let us recall that Unicredit is exposed to the Signa group to the tune of several hundred million euros.