A recent report from the Centre for European Policy (CEP) reveals that Germany reaped substantial economic benefits from the introduction of the euro, gaining almost €1.9 trillion ($2.1 trillion) between 1999 and 2017. The Freiburg-based think tank, affiliated with Stiftung Ordnungspolitik, assessed the impact of the euro on various EU countries. This was the meaning of the CEP think tak in 2019, and it is the explanation of the whole European crisis.

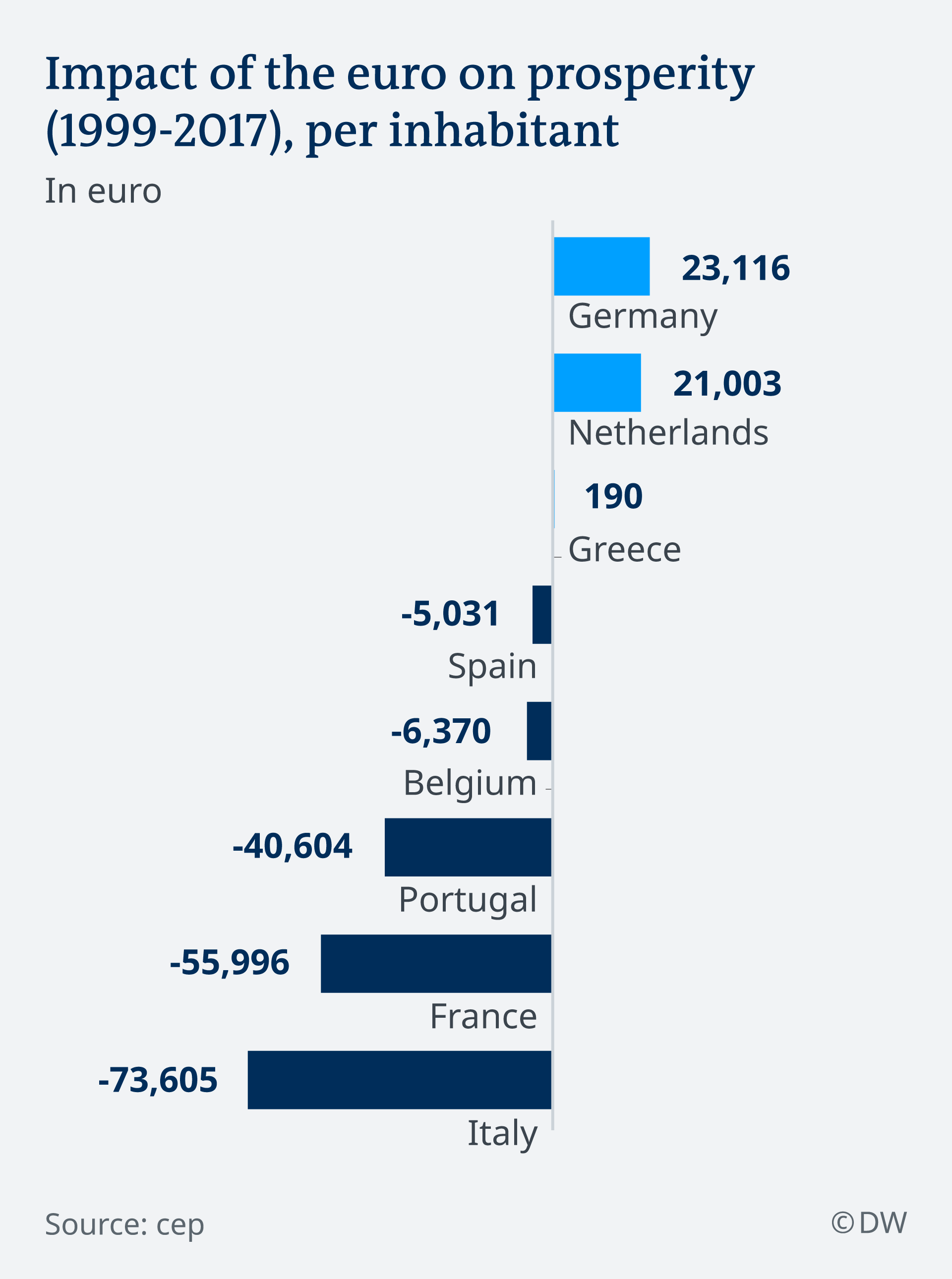

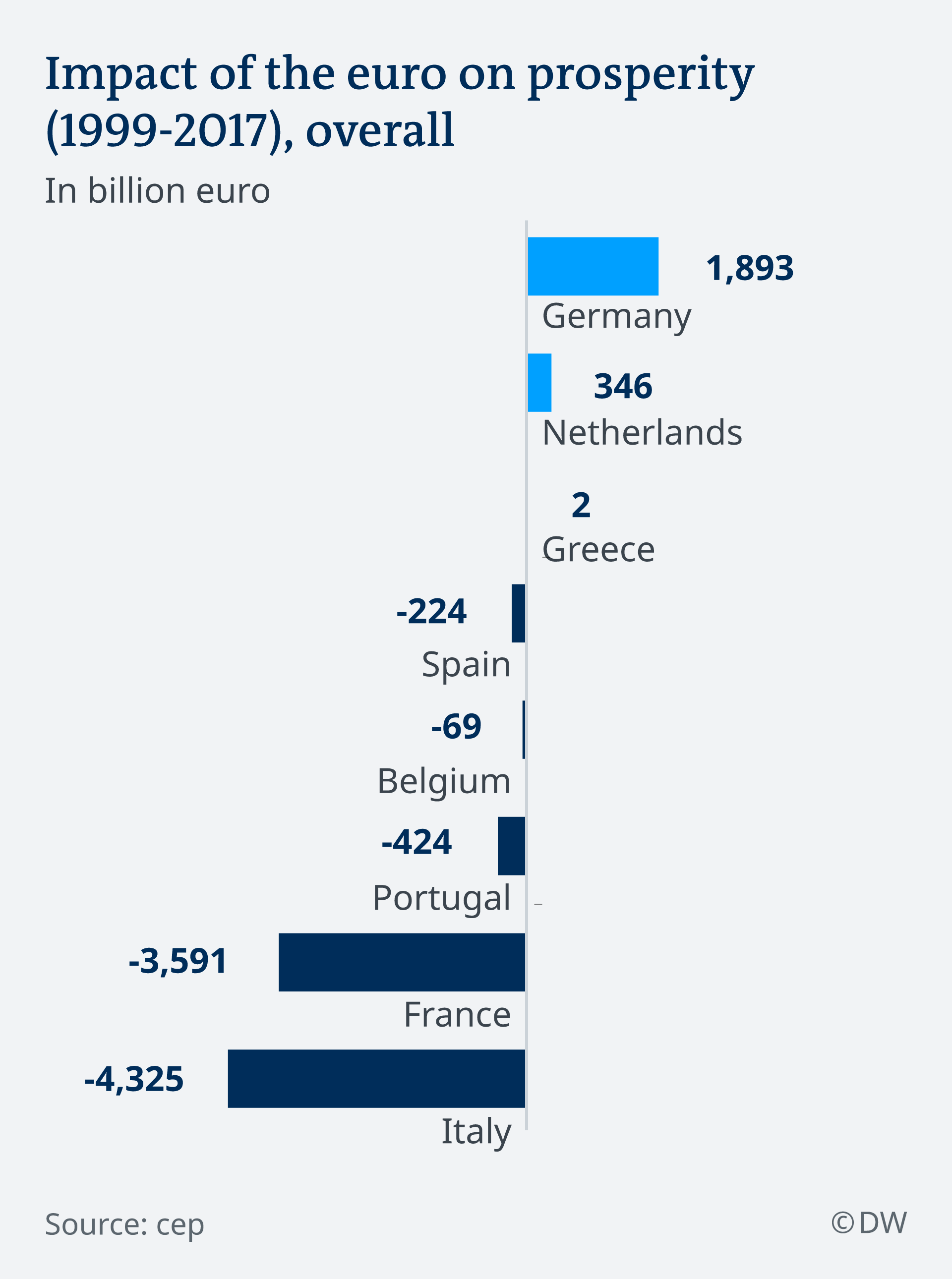

According to the study titled “20 Years of the Euro: Winners and Losers,” conducted by researchers Alessandro Gasparotti and Matthias Kullas, Germany and the Netherlands were the primary beneficiaries of the euro. In Germany, the new currency contributed an additional €23,000 per inhabitant over the two-decade period.

However, the situation contrasts starkly with Greece, which initially experienced significant gains but suffered substantial losses since 2011. Despite gaining €2 billion, Greece’s per capita gains were limited to €190 over the 20-year life of the euro.

Beyond Germany and the Netherlands, the overall trend for the Eurozone indicated a decline in prosperity. France experienced a decrease of €3.6 trillion, and Italy faced a €4.3 trillion reduction, equivalent to €56,000 and €74,000 per capita, respectively.

Total Loss in Million euros

The report attributes the decline in prosperity to a loss of international competitiveness. Before the euro’s introduction, countries had the flexibility to devalue their currencies, making exports more affordable globally. This devaluation acted as a tool to address economic challenges, which the introduction of the euro eliminated. The report emphasizes that the Eurozone has yet to address the issue of divergent competitiveness among its member countries.

The study aimed to isolate the effects of the euro from other factors like politics and reforms. Each surveyed country was placed in a control group with eight other nations exhibiting similar economic trends. The researchers then projected where each country would stand if they had not adopted the euro, considering factors like inflation, industrial output, and import-export levels. Despite acknowledging the method’s superiority, the researchers highlighted the difficulty in analysis due to a lack of reliable empirical data.