International

China: new house prices continue to fall

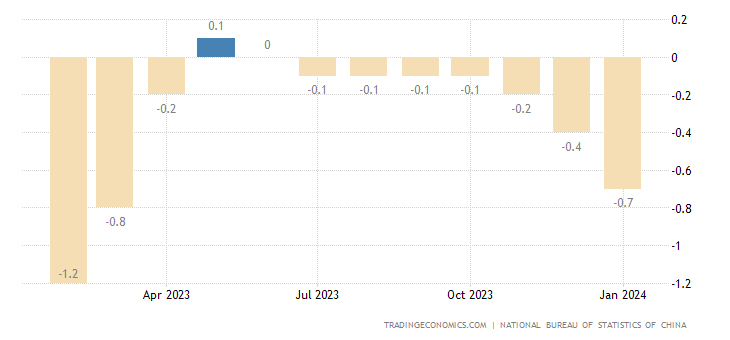

The crisis in China’s real estate sector does not seem to be marking time. New home prices in China declined 0.7 percent year-on-year in January 2024, a larger drop than the 0.4 percent decline in the previous month and one that does not shake hopes for an immediate rebound.

This was the seventh consecutive month of decline and the fastest pace since March 2023, even as Beijing stepped up efforts to mitigate the impact of the prolonged real estate crisis and fragile economic recovery. Prices fell fastest in Shenzhen (-4.1 percent vs. -3.6 percent in December) and Guangzhou (-3.6 percent vs. -3.0 percent), while moderating in Beijing (1.3 percent vs. 1.7 percent), Chongqing (2.0 percent vs. 2.0 percent), Shanghai (4.2 percent vs. 4.5 percent), and Tianjin (2.1 percent vs. 2.3 percent).

On a monthly basis, new home prices fell 0.3 percent in January, following December’s 0.4 percent decline, which was the deepest drop since February 2015.

Here is the chart on an annual horizon:

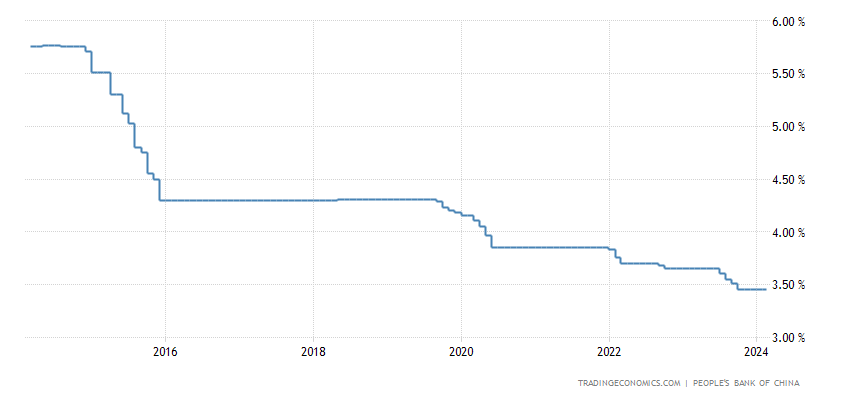

And instead, a longer-term view indicates the severity of this crisis: the slump in Chinese property values was deeper during the 2008–09 financial crisis, but now it looks like a longer-term decline. Not a crash to recover from, but a kind of long agony:

Let’s recall that a few days ago, the PBOC, China’s central bank, lowered long-term interest rates to their lowest in 10 years, precisely with the aim of reviving the real estate sector.

So the country’s economic and political authorities are well aware of the crisis that is running through the real estate market and are well prepared to take measures in this regard. Their effectiveness, however, depends on the effective implementation of many monetary and economic measures and the resolution of structural problems in the market. These are caused, on the one hand, by oversupply and, on the other, by the financial crisis of real estate developers, including the liquidation of Evergrande.