International

United States Existing Home Sales drop, and this could be a problem

Worldwide, the real estate sector is the one most affected by the permanently high interest rates.

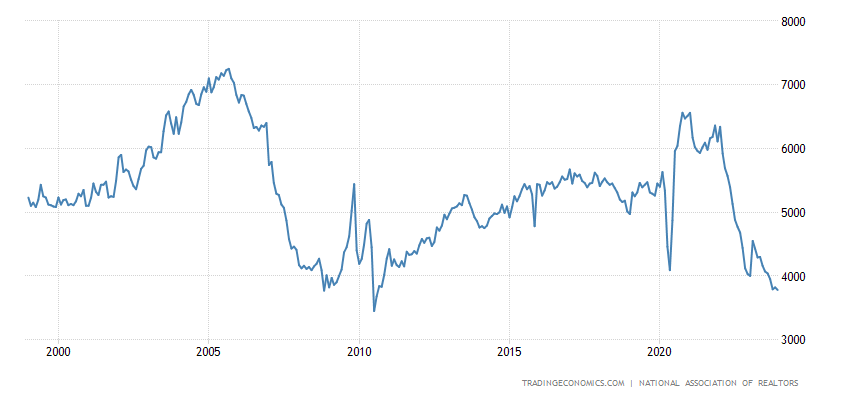

Existing home sales in the United States fell 1.0 percent from the previous month to a seasonally adjusted annualized rate of 3.78 million units in December 2023, reaching the lowest level since August 2010 and falling below the 3.82 million units the market expected.

Sales of single-family homes fell 0.3 percent to 3.40 million, while sales of condominiums and cooperatives fell 7.3 percent to 0.38 million. Among the four major U.S. regions, sales declined in the Midwest and the South but increased in the West while remaining unchanged in the Northeast.

On a year-over-year basis, sales recorded a major 6.2 percent decline. Considering the full year 2023, existing home sales fell to their lowest level in 30 years. “Last month’s sales appear to be the low point before an inevitable upturn in the new year,” said NAR chief economist Lawrence Yun. He attributed this potential recovery to lower mortgage rates than in the previous two months and predicted an increase in inventories in the coming months.

Here is the related graph

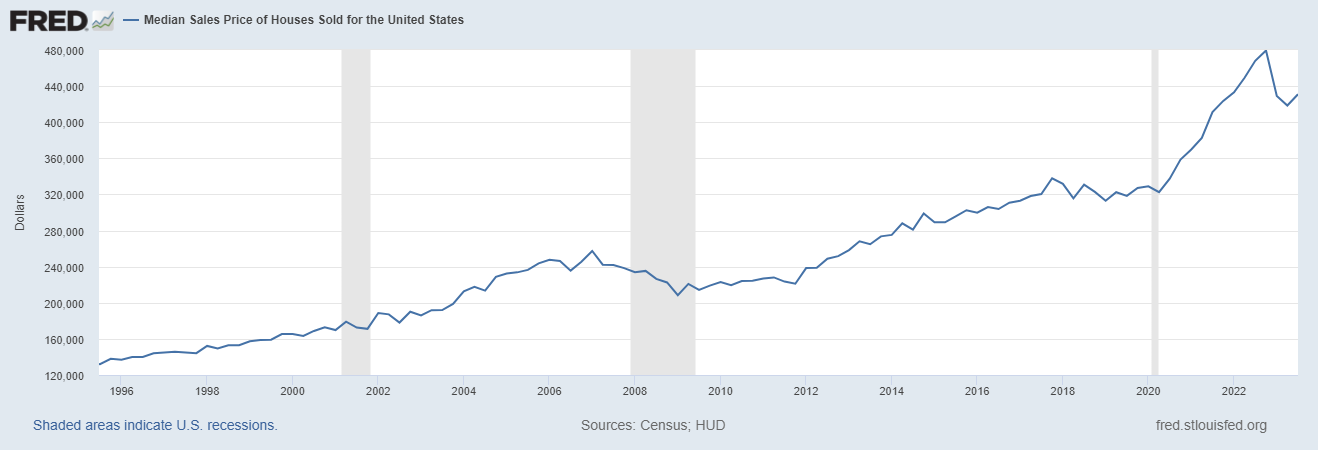

Let’s look at the chart on the average U.S. real estate price compiled by the St. Louis Fed.

When there was a decline similar to the current one in transactions, there was soon after a sharp drop in prices that then vented into the great financial crisis. For the time being, it appears that the price adjustment has ended, but unless sales increase again, it is only a matter of a short time before property values still come crashing down.

Now the U.S. economy is more optimistic, and that is a good thing, but optimism is not always justified, especially if the Fed continues to tighten rates.